By Saket Sundria and Alex Longley

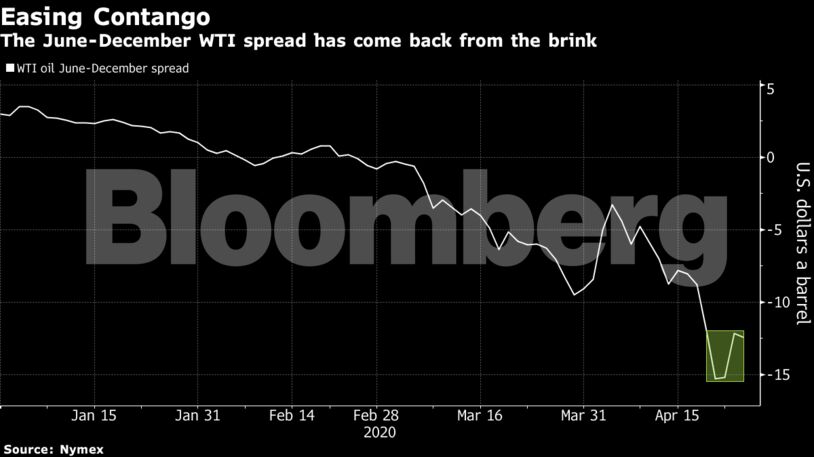

West Texas Intermediate for June delivery increased to near $17 a barrel after the May contract slumped to as low as -$40.32 on Monday before expiring the next day. In response, U.S. operators have started to shut old wells and halt new drilling, actions that could reduce output by 20%. Russia’s seaborne exports from the Baltic will fall to a 10-year low in May, while Kuwait and Algeria said they are reducing production earlier than required under the OPEC+ deal.

Still, a massive glut remains and it won’t clear quickly, consultant FGE said, deepening its forecast for demand loss yet again. In a sign of how severe the supply imbalance is, refiners are hunting for vessels to store gasoline and jet fuel, while an American pipeline operator is looking at ways to free up space on its conduits to stock more crude.

With no clear indication of when demand might recover, the market is set for a prolonged slump that will reshape the industry for years to come. Oil’s collapse will be followed by the weakest recovery in history, according to the World Bank.

“There are only two things that can save the market from its current anguish: a recovery in demand or additional supply cuts,” said Stephen Brennock, an analyst at PVM Oil Associates. “Tumultuous, erratic, and unprecedented — the curtain is about to fall on a historic week for the oil market.”

| Prices: |

|---|

|

Traders are still reeling from the price moves earlier in the week. At least four brokerages — including INTL FCStone Financial Inc. and Marex Spectron — are restricting the ability of clients to enter into new trades in the most active oil benchmarks in a bid to curb losses. Tokyo’s stock exchange warned investors that some oil-linked products are seeing large amounts of volatility.

Producers and refiners are also starting to declare force majeure in what could be a wave of broken contracts. American shale explorer Continental Resources Inc. told at least one refiner it won’t make an oil delivery after the price rout, while the trading unit of Petroleos Mexicanos said it couldn’t import gasoline from at least one U.S. company.

“Should global storage reach full capacity over the coming weeks, only the amount of oil that is demanded can be produced,” said Ole Hansen, head of commodities strategy at Saxo Bank. “An event that could force major shut-ins from oil producers around the world.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS