By James Thornhill and Alex Longley

Futures in New York climbed around 3% toward $25 a barrel. Saudi Arabia and Russia are hammering out an agreement that a delegate said will reduce global output by about 10 million barrels a day. That compares with OPEC’s estimate for demand to fall by 11.9 million barrels a day this quarter. Meanwhile, India — the world’s third biggest oil consumer — is set to snap up millions of barrels of Middle East crude for its strategic reserves to take advantage of low prices, according to officials with knowledge of the matter.

Despite the higher oil prices in the futures market, physical ones continue to fall as refineries cut the amount of crude they process and purchase. North American landlocked crudes are fetching lower and lower prices. In Canada, oil from Alberta is now worth just $3.92 a barrel, while crude in the U.S. Bakken region is back beneath $10. For oil companies, what matters is the price on the physical market. And policy makers are warning more pain is coming for them. Alberta Premier Jason Kenney on Tuesday warned there was a “very real possibility” of negative prices.

“With many physical crude markets in distress, production should already be in decline around the world and a slow improvement in the overall balance could set in soon even without OPEC++ help,” analysts at consultant JBC Energy GmbH said Wednesday in a note.

| Prices: |

|---|

|

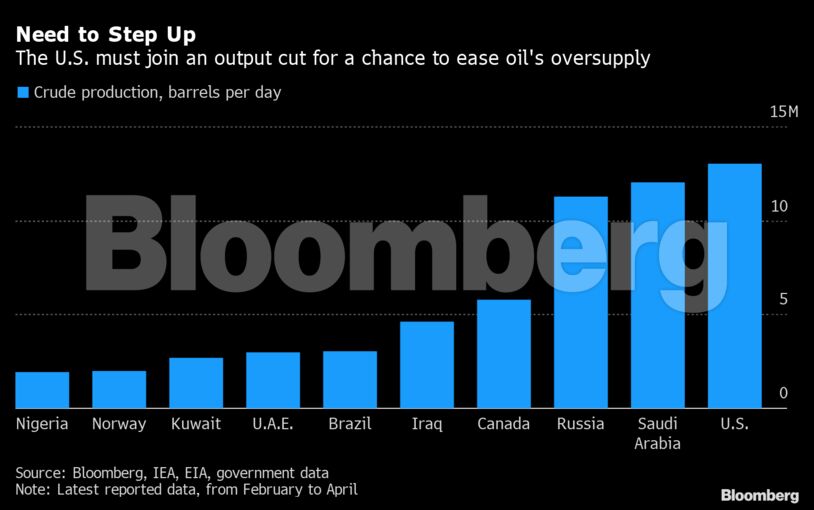

Some form of cooperation from the U.S., the world’s biggest producer, will be required for a coordinated OPEC++ production cut, according to delegates involved in the talks. However, a drop in America’s crude output forecast released Tuesday could be enough to satisfy Riyadh and Moscow. The Energy Information Administration said it expects production to average 11.76 million barrels a day.

In the short-term, the U.S. market is looking weak. WTI time spreads have been hammered on expectations of record builds at the key U.S. storage hub at Cushing, Oklahoma. American inventories rose by almost 12 million barrels last week the API reported, while those in Europe grew by a similar amount according to Kayrros.

Adding to the pressure is a bumper roll of the $2.7 billion U.S. Oil Fund ETF. The fund holds about 20% of the May WTI contract and is set to move that position to the June contract over the coming days.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein