By Anya Andrianova and Natasha Doff

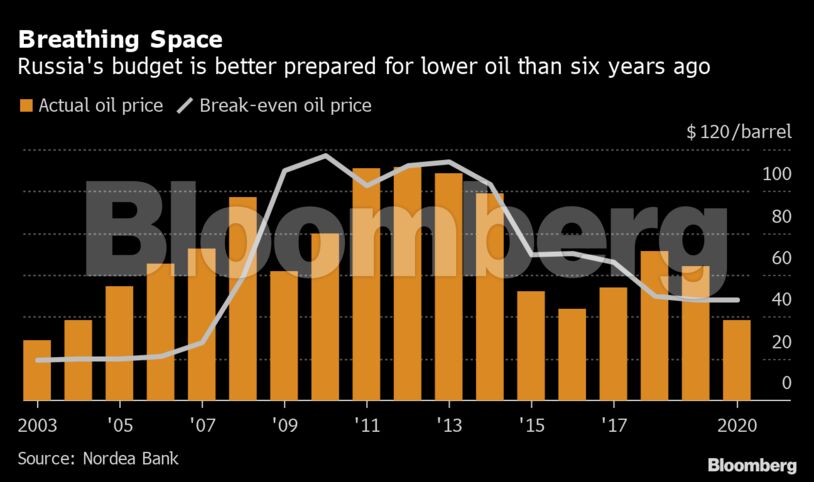

Russia has spent the past five years tightening its budget and building up more than $550 billion in reserves — leaving it in a stronger position than oil-market rival Saudi Arabia. Realistically, though, the Kremlin could begin feeling the pain if the crude price war lasts much more than a year, according to analysts.

Particularly at risk are the spending increases President Vladimir Putin has promised to help turn around long-stagnant living standards.

“If in a year they see that the oil stabilizes near $30, then they will have to take measures to cut spending or raise taxes, there are no other options,” said Natalia Orlova, chief economist at Alfa-Bank in Moscow.

Saudi Arabia Escalates Price War With Huge Oil Output Hike

Saudi Arabia’s Economy Can Ill Afford Oil-Price War It Began

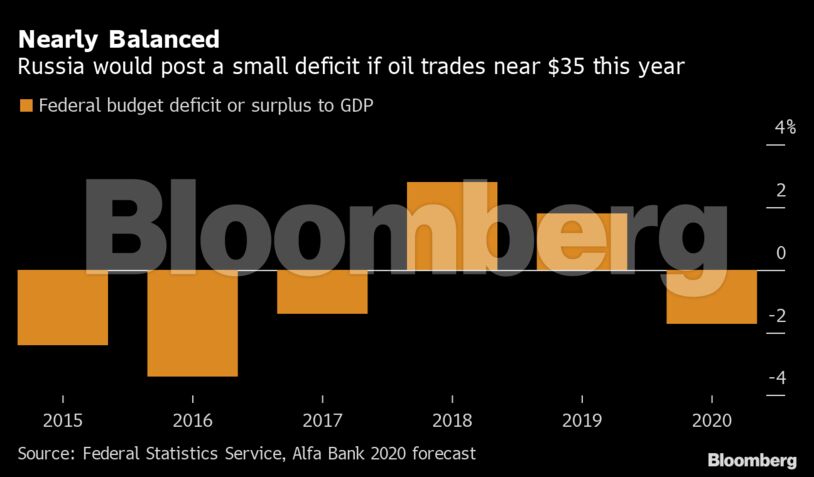

At $35 a barrel, Russia’s budget could hold on for about three years, according to Karen Vartapetov, an analyst at S&P Global Ratings in Moscow. Until this week, the central bank considered these prices a “risk scenario,” estimating in a report published last year that $25-a-barrel oil would push the Russian economy into recession this year.

For the moment Putin is exuding confidence, telling lawmakers Tuesday that Russia will weather the current economic storm as he endorsed plans that could allow him to stay in office for as much as 16 more years.

Putin has made economic growth a focal point of his presidential term that ends in 2024, and was planning to boost spending this year on infrastructure and social support to 1.3% of gross domestic product. Underspending and shrinking incomes have been a key factor in the recent slide in Putin’s popularity ratings.

Even before the recent drop in oil prices, the government planned to take some of the cash for the spending spree from its rainy-day fund, where Russia saves extra oil revenue. If oil prices stay low, the policy makers will have to draw much more from the fund to pay for spending.

“Any such depletion of the sovereign wealth fund would leave Russia in a very vulnerable financial position,” said Christopher Granville, managing director at TS Lombard.

On Tuesday, the central bank began spending some of that money, buying rubles to support the currency after the rout in oil prices made it the worst performer globally.

What Our Economists Say…

“The government is right that its fiscal buffers are big enough to sustain spending for years, but our estimate is closer to six than 10. Non-energy revenue could also be lower in an economic downturn, putting additional stress on the budget.”

— Scott Johnson, Bloomberg Economics

To be sure, the weaker ruble will provide some support to the budget, partially making up for the decline in oil prices. The Finance Ministry estimates that a 1 ruble drop in the exchange rate brings in about 70 billion rubles ($970 million) of extra revenue from taxes on energy exports.

“If they spend money frugally, then theoretically Russia can go through its National Wellbeing Fund in six years,” said Alexandra Suslina, a budget specialist at the Economic Expert Group, a Moscow think-tank that frequently advises the government.

But the recent market volatility is also likely to force the central bank to halt rate cuts, which had been expected to help fuel growth this year. Economists at Morgan Stanley and Emerginomics this week changed their forecasts for Russia’s interest rate decision later this month from a cut to a hold.

Vladimir Tikhomirov, an economist at BCS Financial Group in Moscow, estimates that the economy could shrink 0.5% this year if oil prices average $35 a barrel.

“The Finance Ministry doesn’t factor in a reduction in economic activity, so we see their estimate as overstated,” Tikhomirov said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire