By Alex Longley

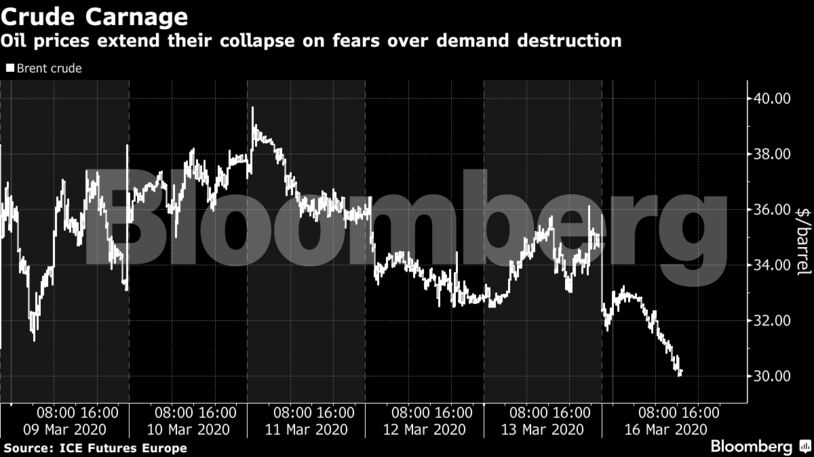

Even a massive emergency move by the U.S. Federal Reserve to cushion the world’s biggest economy just added to the fear gripping markets. Forecasts for global oil use are being cut dramatically as government measures to contain the spread of the pandemic restrict the movement of people and throw supply chains into chaos. At the same time, giant producers are unleashing a flood of supply after the disintegration of the OPEC+ alliance.

“Oil prices remain in freefall,” Commerzbank analysts including Carsten Fritsch wrote in a report. “The more countries ‘freeze’ public life, close their borders and cancel flights, the greater the impact will be on oil demand.”

Oil traders, executives, hedge fund managers and consultants are revising down their estimates for global oil demand. The growing fear is that consumption, which averaged just over 100 million barrels a day in 2019, may contract by the most ever this year. That would easily outstrip the loss of almost 1 million barrels a day in 2009 and even surpass the 2.65 million barrels registered in 1980, when the world economy crashed after the second oil crisis.

Travel restrictions across the globe tightened further over the weekend, with the U.S. extending its travel ban to include Britain and Ireland. Australia said anyone entering the country must self-isolate for two weeks, Spain imposed a lockdown and France closed cafes and restaurants.

New York City limited restaurants and bars to takeout and delivery service, and shut nightclubs, movie theaters and concert venues. The U.S. Centers for Disease Control and Prevention recommended postponing any events with more than 50 people for the next eight weeks.

The Fed cut its benchmark rate by a full percentage point to near zero and will boost its bond holdings by at least $700 billion. The move could trigger a fresh round of monetary easing around the world as countries look to keep money flowing as economic activity grinds to a halt. It wasn’t enough to calm markets though as U.S. equity futures hit limit down.

| Prices: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire