By Alex Longley

Futures in London fell as much as 9.4% to the lowest since November 2002, while New York crude briefly dipped below $20 a barrel. The huge oversupply is further collapsing the oil market’s structure, and there may be more weakness to come as the world quickly runs out of storage capacity. The slump in demand has shut refineries from South Africa to Canada.

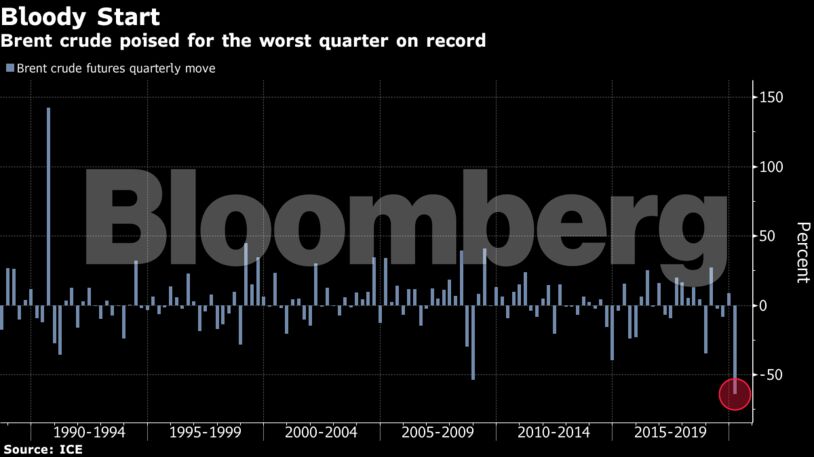

Prices are on track for the worst quarter on record. Goldman Sachs Group Inc. estimates consumption will drop by 26 million barrels a day this week as measures to contain the coronavirus hurt global GDP. Meanwhile, Riyadh and Moscow are showing no signs of a detente in their supply battle as Saudi Arabia announced plans to increase its oil exports in the coming months.

“Market participants and oil producers are now shaken to the bone over what is playing out in the oil market,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The world cannot store the current surplus.”

| Prices: |

|---|

|

In the market for actual barrels of crude, prices are already far below those of futures benchmarks. Oil from Canada now costs little more than $5 a barrel, while traders were bidding for some barrels in negative territory on Friday.

It’s a similar picture in Europe, where Kazakh crude was offered at a 10-year low. As a result, the six-month contango on the global Brent benchmark has grown bigger than in the financial crisis, at more than $13 a barrel.

The plunge in prices has caused distress in some OPEC nations. Algeria, which holds the cartel’s rotating presidency, urged the secretariat to convene a panel but the call has failed to gather the majority backing necessary to go ahead. Riyadh is among those opposing the idea.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire