By Sharon Cho and Alex Longley

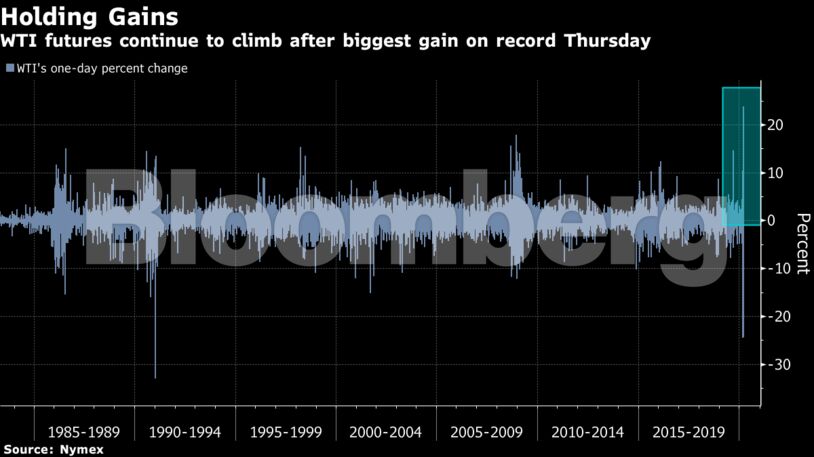

Futures in London topped $30 a barrel, continuing a rebound from their lowest level since the early 2000s. Texas’s main oil regulator is considering curbing output for the first time in almost half a century, though the idea is still in preliminary discussions.

President Trump has said he could intervene in the deepening price war between Saudi Arabia and Russia when the time is right. Though that’s given renewed optimism to markets that a deal can be found, Russia is said to be planning to hold out amid crude’s slump.

While oil has clawed back some losses, the market is bracing for a slump below $20 a barrel, according to a Bloomberg survey. While Saudi Aramco said it will cut domestic refining to free up more crude for export, analysts at MUFG Bank Ltd. said the price war is a “lose-lose strategy” for the kingdom and Russia, with the fiscal and revenue outlook for both countries would be challenging if crude holds below $40 for a protracted period.

“With other governments manipulating oil markets, it’s fair to ask: Why shouldn’t our government step in to try to reinstate a more market-based approach?” Ryan Sitton, one of three voting members of the Texas Railroad Commission, said in a Bloomberg Opinion column. “It would stave off a total oil industry meltdown.”

Saudi Arabia has ordered state-run Aramco to keep output at a record 12.3 million barrels a day over the coming months, but in a surprise move, both the kingdom and Iraq cut the rebates on freight costs they give to customers, effectively lifting prices for some buyers in Europe and the U.S.

As a support measure for U.S. drillers, the Trump administration plans to initially purchase 30 million barrels for the Strategic Petroleum Reserve in May and June, and buy as much as 77 million barrels in total over time. Still, measures may go further, with Sitton proposing a plan in which Texas, the world’s third-largest crude producer, joins the two larger producers to curb supply, asking for federal support to negotiate with the other countries.

The American shale industry has found itself caught in the middle of a fight over market share between Saudi Arabia and Russia. The sector has so far scaled back operations and is also threatened with a wave of bankruptcies.

| Prices: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire