By Michael Bellusci

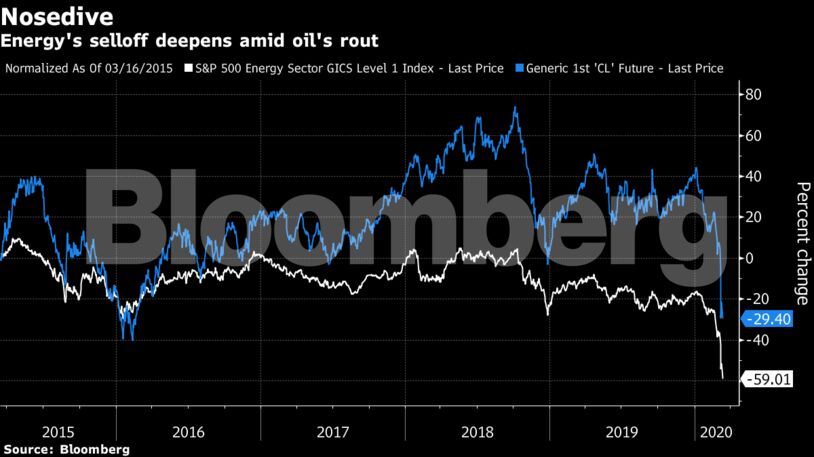

The S&P 500 Energy Index fell more than 10% on Thursday to its lowest since March 2004. The 27-member index has fallen almost 30% this week as crude lost about a quarter of its value. The sector has been among the hardest hit as the coronavirus pandemic reduces the demand outlook while Russia, Saudi Arabia and other Middle East nations jostle to raise production.

Thursday’s laggards include Marathon Petroleum Corp., Apache Corp., Oneok Inc, and Occidental Petroleum Corp, all down at least 15%. Apache Corp. became the latest U.S. shale oil producer to cut its dividend and slash capital spending after the huge drop in global prices this week.

“No independent E&P that we cover can sustain sub-$40 crude while seeking to generate free cash flow and support a dividend,” Bloomberg Intelligence said. Balance sheets are stronger in the current downturn versus 2014 levels, though capital markets are effectively shut.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet