By Laura Millan Lombrana, Jess Shankleman and Akshat Rathi

“Developments over the past week have greatly increased the likelihood that the global economy is moving into recession in response to the surge in COVID-19 cases worldwide, the associated disruption, and the aggressive market sell-off,” said Ben May, director of global macro research at Oxford Economics.

Electrification is here to stay, the conventional wisdom holds, but these developments are bad news for industries that were looking to tip the scales in favor of electric this year.

“People aren’t shopping for cars right now,” said Ram Chandrasekaran, global lead for transportation and mobility at consultancy Wood Mackenzie. “Who is going to go out and make a big jump to say they’ll buy a new electric car when they’ve never owned an electric car before?”

The global auto market will be hit hard by the economic contraction, according to analysts from BloombergNEF, leading to negative consequences for electric vehicle sales and battery manufacturing capacity. Early BNEF data shows overall vehicle sales have dropped 44% in China in January and February vs. the same period in 2019, and 18% in South Korea, two of the countries hit hardest by the disease outbreak.

Electric car sales, which had been on the rise in recent years, are sensitive to patterns in the broader auto market. Sales in Europe still are expected to increase 50% from last year and China sales could be flat or drop if the recovery from the virus drags on.

Carmakers such as Volkswagen, Geely and General Motors have poured billions into EVs, with rollouts still expected this year. In Europe and China, strong regulations will continue to push the market forward. Volkswagen currently is releasing the new ID.3 hatchback and will offer a compact SUV sibling later this year to be sold in Europe, China and the U.S. Ford is rolling out the Mustang Mach-E later this year.

“We have a clear commitment to become carbon neutral by 2050, and there is no alternative to our electric-car strategy to achieve this,” Michael Jost, strategy chief for Volkswagen told reporters on March 12. The price fall is “one of those dips that last a month, or some months or maybe a year,” he said, but in the long-term, oil won’t get cheaper.

Particularly in the U.S., cheap oil could encourage some buyers to purchase combustion engine vehicles. “It’s certainly bad news for any electric vehicle launch if a drop in gas prices stays around for several months,” said Mark Wakefield, head of automotive practice at AlixPartners. If the gas-price drop “gets to a level where consumers can start to trust it, they will shift out of fuel-efficient cars into less fuel-efficient cars.” On March, 16, U.S. gasoline plunged 23 percent to its lowest level since 2005.

Beijing Electric Vehicle Co., China’s biggest electric car maker, said in a Wechat message in early March that it has no plans to adjust its production or sales plan on the fluctuation of oil prices. The company’s new energy unit is focusing on preventing the epidemic and steadily resuming work.

In China, the world’s largest electric-car market, subsidies resulted in a doubling of sales in 2018. A partial withdrawal of the subsidies last year led to a slowdown, but sales kept increasing at double-digit rates. CRU Group, a commodity consultancy, recently cut its 2020 sales estimate to 1.35 million, from 1.5 million, due to the impact of the country’s coronavirus outbreak on the economy. That’s still higher than the 1.2 million EVs sold in 2019.

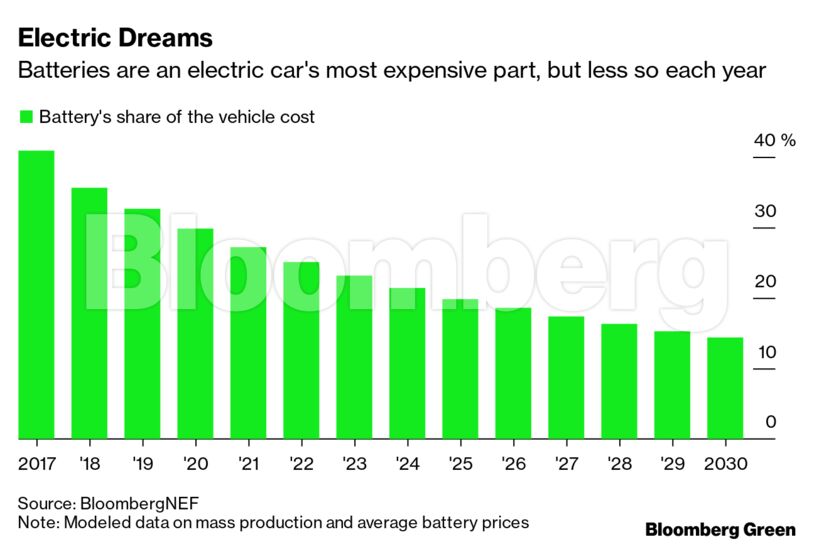

Colin McKerracher, a transportation analyst with BloombergNEF, said he expects EV sales to grow in Europe this year, despite a contraction in the overall vehicle market. “For most consumers, high upfront prices are the biggest thing that’s holding EVs back,” McKerracher said. “Battery prices matter more than oil prices, and if those keep falling, EV adoption will keep going up in the medium to long term, but the next 12 months could still be really ugly for the market.”

Governments in China and in the European Union implemented measures to accelerate the electrification of transport regardless of oil prices, said Jose Lazuen, senior automotive practice analyst at Roskill. Concerns over pollution in large cities and its impact on citizens’ health have been more prominent, and oil price swings are unlikely to change that, he said.

“Long-term, the vision of these governments is to diminish exposure to oil markets as much as they can,” Lazuen said. “Whether that will happen in the next 10 or 50 years, we don’t know.”

Electric cars cost 50% to 70% more than conventional automobiles, but are forecast to decline in the coming years as lithium-ion battery technology evolves and manufacturers ramp up production. At the current pace, Roskill estimates that the cost of electric vehicles will start to match that of internal combustion engine cars beginning in 2023.

Diego Diaz, head of new ventures and technology prospects at Iberdrola SA, says there are other factors beyond cost that will drive the sales of EVs. “We have seen steady policy support for concerns around air quality and climate change, and we foresee that this will continue.”

The Spanish utility on March 10 announced it will invest 150 million euros ($171 million) to boost its network of electric-car chargers in Spain to 150,000 by 2025, from the current 5,000.

Oxford Economics’ May cautions against the idea there is a global financial crisis style recession on the way. “As normality returns, households will begin raising discretionary spending back to more typical levels, while firms will also increase output as supply constraints lift. The money saved because planned discretionary spending during early 2020 didn’t take place may burn a hole in households’ pockets, meaning that most will eventually be spent rather than saved.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein