By Josh Petri

It’s a question you’ve likely heard a dozen times. Either in tech (if you work in tech) or in a former tech worker’s uncanny memoir (if you read about tech) or in a high-brow satire of tech culture (if you enjoy painful humor).

Solar energy certainly has scaled. Installations are now approaching the magnitude of coal-, oil-, and natural gas-fired plants. Developers commissioned at least 35 projects of at least 200 megawatts worldwide last year, a record. With about 3,000 solar panels needed for each megawatt of capacity, a 200-megawatt project would be at least as big as 550 American football fields.

Why has everything suddenly gone super-sized? It’s a matter of simple economics. Bigger projects allow developers to drive down the price of electricity for consumers, in turn running smaller plants into the ground.

Those massive installations, however, require massive manufacturing capabilities. The coronavirus—which has killed more than 2,800 people—is threatening to decrease production of solar and wind equipment. The outbreak “may very well slow down global renewable energy deployment,” said Ali Izadi-Najafabadi, head of analysis in Asia for BloombergNEF, which has downgraded its outlook for installations this year.

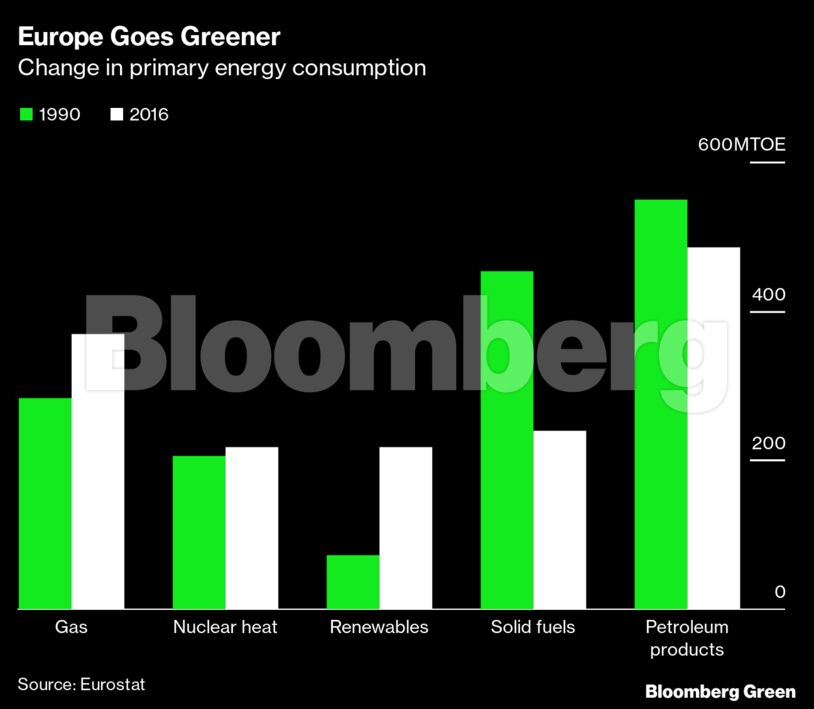

The European Union in particular has emerged as a leader in the fight against rising emissions, thanks to the concerted effort of a network of climate activists. European Commission President Ursula von der Leyen recently announced plans to make the bloc the first climate-neutral continent by 2050.

The U.S., meanwhile, has yet to pass similar legislation, with even smaller projects subject to the whims of domestic politics.

The U.S. Army Corps of Engineers this week stopped a multiyear study of strategies and projects meant to protect the New York City metropolitan area against catastrophic storm surges and rising seas. The decision is the latest in a series of policy moves by President Donald Trump’s Republican administration—including blocking the replacement of a damaged Hudson River tunnel and suspension of New York airport “trusted traveler” applications—that local politicians contend are aimed at punishing a Democratic leaning region.

Even some on Wall Street are having difficulty contributing to the fight against global warming. Although many are clamoring for sustainable investing, the recent liquidation of an ESG fund illustrates a growing concern in the financial industry: The lion’s share of new investment is still going to the world’s biggest managers, who can offer the lowest fees.

Josh Petri writes the Week in Green newsletter recapping the best reads and key news in climate change and green solutions. Sign up to receive the Green Daily newsletter in your inbox every weekday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS