By Saket Sundria and Grant Smith

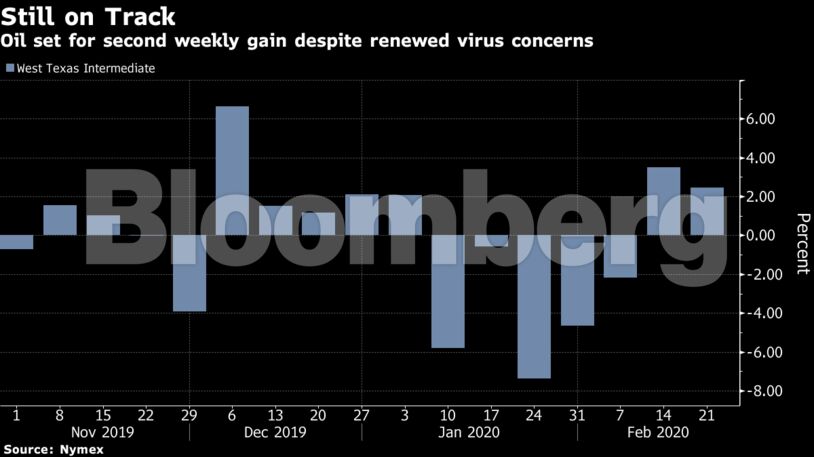

Futures in New York fell 1.6%, yet remain about 2% higher this week after China, South Korea and Singapore started rolling out measures to protect economic growth as the virus hits businesses and travel. Commodities had rallied prematurely, focusing on the planned stimulus and ignoring the immediate disruption, according to Goldman Sachs Group Inc.

The rate of infections has declined in Hubei, the epicenter of the outbreak, but investor anxiety has crept back in as the virus spreads globally. The World Health Organization said if countries don’t respond strongly now to the outbreak, the spread outside China may become a wider threat. Asian stocks retreated and gold climbed.

“Commodities are poised for a sell-off,” said Jeff Currie, head of commodities research at Goldman Sachs in London. The Chinese “economy has yet to materially restart, creating significant surpluses in key markets.”

Oil had rallied since early last week as China has announced measures to boost foreign trade and eased borrowing costs, while Singapore has pledged $4.6 billion in dedicated support for the economy.

Prices have also been supported recently by threats to supply, most notably American sanctions on a Rosneft PJSC unit that could impede flows from Venezuela, and a flare-up in violence in Libya.

A smaller-than-expected increase in U.S. crude stockpiles also provides a positive for the global supply picture. Inventories expanded by 415,000 barrels last week, well below a forecast 3.2-million barrel gain by analysts surveyed by Bloomberg, while supplies fell at the storage hub of Cushing.

West Texas Intermediate for April delivery fell 68 cents to $53.10 a barrel on the New York Mercantile Exchange as of 10:17 a.m. in London. Front-month prices are up 1.9% for the week.

Brent for April settlement declined 98 cents, or 1.7%, to $58.18 on the ICE Futures Europe exchange. The contract rose 0.3% on Thursday for an eighth consecutive increase, the longest run of gains in more than a year. Prices are up 1.8% this week.

| Other oil-market stories |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire