By Grant Smith and Saket Sundria

Citigroup Inc. said that markets had become overconfident in expecting a V-shaped rebound from the epidemic and oil prices are likely to remain weak during the first half of the year.

The supply-chain recovery in China could be problematic despite the stimulus pledge from Beijing, Citigroup analysts including Edward Morse said in a note to clients. Total Chinese product demand may drop by about 3.4 million barrels a day in February and be 1.5 million barrels per day lower on average in the first quarter.

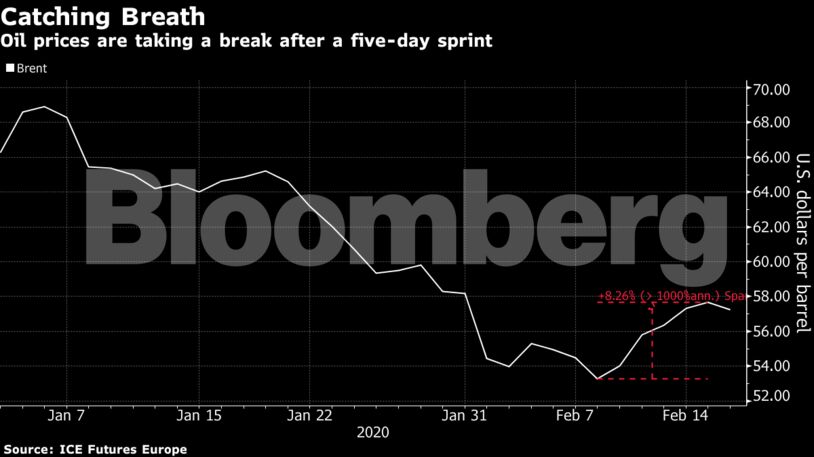

Brent oil rallied the past five days — the longest run of gains this year — amid optimism the worst economic impacts of the coronavirus had been accounted for. China pledged a raft of fiscal stimulus measures to offset the disruption, and Singapore planned to boost spending to counter the slowdown in tourism and trade.

“The short-covering rally failed to gain traction, with the overhang of supply weighing on the market,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S in Copenhagen. “Activity is slowly picking up, and while oil demand for storage has remained robust, the demand for products remains low. The market will have to live with this being — at best — a W-shaped recovery rather than a V-shaped one.”

Brent for April settlement fell $1.21 to $56.46 on the ICE Futures Europe exchange as of 1:16 p.m. in London. West Texas Intermediate futures for March delivery declined $1.02 from Friday’s close to $51.03 a barrel. There was no settlement Monday due to the Presidents’ Day holiday in the U.S.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein