By Sharon Cho and Alex Longley

Crude is still down about 16% this year as the spread of the virus curtails travel and fuel consumption, upending trade flows worldwide. The oil market’s structure also deepened further into a bearish contango this week, suggesting ample supply. Major companies from BP Plc to Total SA expect the disease to wipe out up to a third of global demand growth in 2020, but OPEC itself has predicted a more modest decline even in a worst-case scenario.

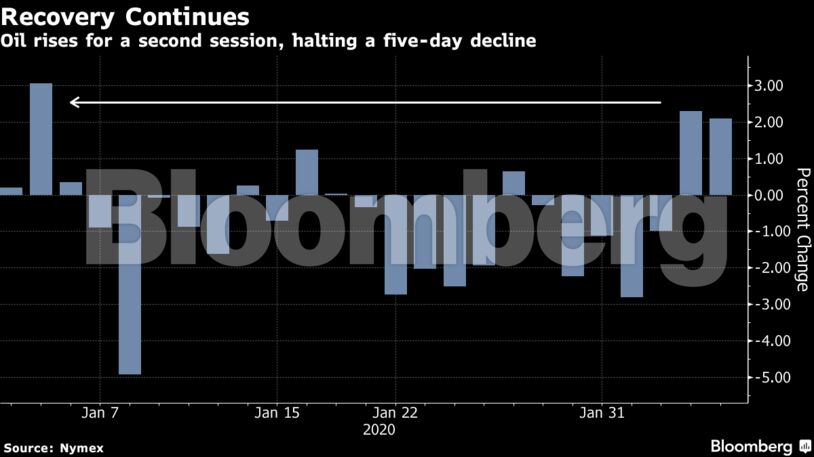

West Texas Intermediate crude advanced 0.9% to $51.21 a barrel on the New York Mercantile Exchange as of 11:46 a.m. London time, after earlier gaining as much as 2.9%. Brent was 0.2% higher at $55.39.

Officials from Moscow who attended the OPEC+ technical committee meeting in Austria asked for more time to hold consultations back home, a delegate said. Saudi Arabia continues to push for an output cut. The dynamic between the two countries is not new. They have often disagreed about whether to curb production since the OPEC+ alliance was formed, but have ultimately found a way to compromise.

Oil prices, however, received a boost after proposals by China to lower tariffs on U.S. goods, effective Feb. 14. On the same day, the U.S. will also implement reductions in levies on Chinese products.

“With millions in quarantine due to the coronavirus and its economic slowdown, China is going to be cutting back on oil imports anyway, making the cut in tariffs less significant in lifting oil purchases,” said John Driscoll, chief strategist at JTD Energy Services Ltd.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS