By Elise Young

“Why are you investing in companies that are involved in the destruction of people’s habitats — and then fueling extreme weather events that affect other parts of your portfolio?” said Tina Weishaus, a spokesperson for the DivestNJ Coalition, a group of environmental organizations that’s pressuring the State Investment Council to abandon fossil fuels and urging lawmakers to ban such investments.

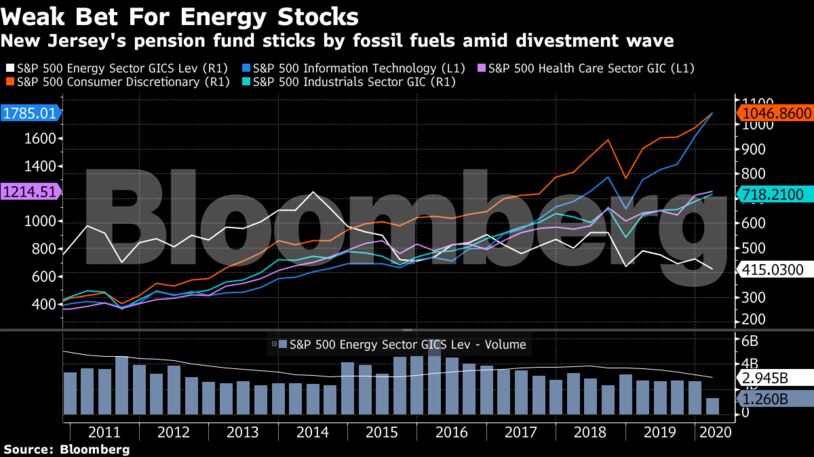

The S&P 500 energy sector returned 7.6% in 2019, the index’s weakest performance by far, and is expected to continue a years-long streak of lagging behind the broader market amid a glut in supplies and threats to demand. Since Murphy took office in January 2018, Exxon has lost 30% of its value.

Murphy, a retired Goldman Sachs Group Inc. senior director, said at a Feb. 11 news conference in Maple Shade that the state has a “sort of social responsibility parameter that applies to our investment decisions, which are taken by the investment council, not by yours truly.”

The state investment division is seeking climate-risk analysts and planning to hire a sustainable portfolio manager, according to Jennifer Sciortino, a treasury spokesperson.

The division “believes the best financial outcomes will result from active engagement on climate change issues,” Sciortino said in a statement. “Divestment, in contrast, eliminates the division’s influence as a shareholder and, consequently, its ability to effect positive change that may lead to favorable investment returns.”

Plant Emissions

Exxon spokesperson Casey Norton declined to comment on New Jersey’s holdings, but said the company has invested more than $10 billion in pollution-lowering technology over 20 years.

“We’re committed to doing our part to identify scalable solutions for the dual challenge of meeting a growing demand for energy and lower emissions,” Norton said in an email.

Over 10 years, the California Public Employees’ Retirement System, California State Teachers’ Retirement System and the Colorado Public Employees’ Retirement Association lost more than $19 billion as a result of their fossil-fuel investments, according to Toronto-based Corporate Knights, a research firm that promotes sustainable business.

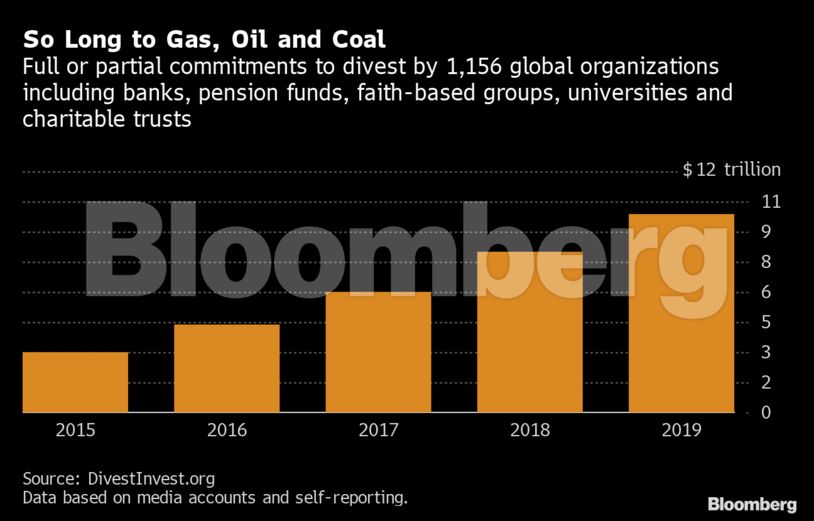

Fund overseers disagree on whether divesting or investing is a better tool for climate change.

Calpers, the largest U.S. pension fund with $404 billion, and the $252 billion Calstrs have cited their proxy power as among the reasons to stay in fossil fuels. Trustees of Grinnell College in Iowa studied divestment for its $2 billion endowment and in 2018 concluded they had “not found any compelling evidence that the action of divesting fossil fuel stocks has an impact on climate change, particularly as a result of financial pressure.”

On the other side of the debate, the University of California said in September that it would cut non-renewables from the $13.4 billion endowment and $80 billion pension fund.

“We must meet the needs of our current operations and the current requirements of our retirees without compromising our ability to serve future students, staff members and faculty,” according to a statement posted to the website of Jagdeep Singh Bachher, the school’s chief investment officer.

A Feb. 4 Harvard faculty vote called for the $40 billion endowment fund to get out of oil and gas; two days later, Georgetown University President John DeGioia said the $1.66 billion endowment will drop non-renewable energy.

“Divestment allows us to divert more capital to fund development of renewable energy projects that will play a vital role in the transition away from fossil fuels,” Michael Barry, Georgetown’s chief investment officer, said in a news release.

In January, New York City’s pension board created a panel to explore divestment for the $216 billion fund. The New York State Common Retirement Fund, the third-largest U.S. public pension with $226 billion, said it was reviewing 27 mining companies that derive at least 10% of their revenue from coal burned to produce electricity.

“Investors who fail to face the risks and seize the opportunities presented by climate change put their portfolios in jeopardy,” State Comptroller Thomas P. DiNapoli, whose Climate Action Plan seeks to cut the state pension’s carbon footprint, said in a statement.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso