By Kevin Crowley

The shares have been under pressure since Exxon disclosed disappointing fourth-quarter results in late January and prospects for a near-term recovery were dimmed by the spreading coronavirus. Excess supplies of natural gas, chemicals and motor fuels also weighed on the oil supermajor.

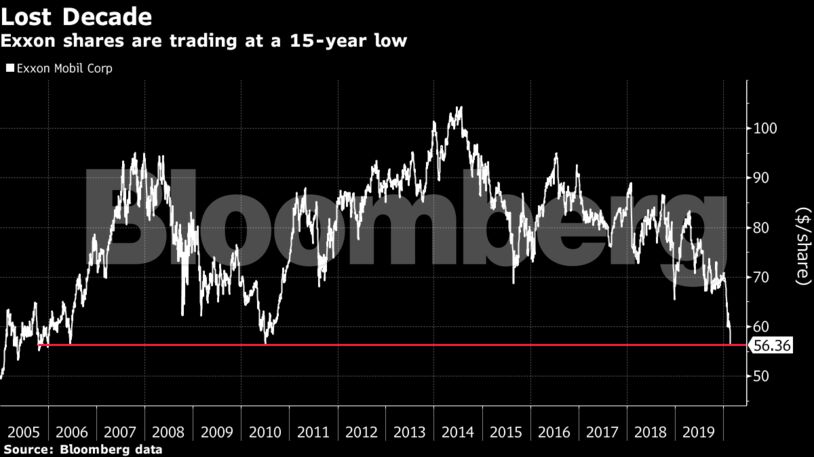

Exxon fell 4.7% to close at $56.36 on Monday in New York as Brent crude tumbled to about $56 a barrel. The last time the Texas-based driller’s stock traded at this level was the end of 2005, when crude fetched $59.

Exxon has been scrutinizing employee-travel budgets since posting its worst quarterly profit in almost four years, people with knowledge of the matter told Bloomberg News earlier this month. Auditing teams have fanned out to some divisions to analyze travel requests involving industry conferences, the people said.

Woods is focused on rebuilding Exxon’s portfolio of crude and gas projects through new drilling from Guyana to Mozambique. But investors have so far balked at the huge cost. Woods is scheduled to defend his strategy in a day-long presentation on March 5 in New York.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS