By Bloomberg News

Quarantines and extended holidays have idled cars and airplanes and shuttered coal mines and steel mills, some of the biggest contributors to the greenhouse gases that drive global warming. That’s going to drive a reduction in emissions early in the year, although whether it’s enough to deliver a year-on-year drop depends on how long economic activity remains depressed and what kind of stimulus measures the government enacts once the outbreak is contained.

“The coronavirus should be expected to reduce China’s carbon emissions in the first quarter,” said Melissa Brown, director of Asia energy finance studies for the Cleveland, Ohio-based Institute for Energy Economics and Financial Analysis. “The real question will be how the coronavirus affects economic activity more broadly and for how long.”

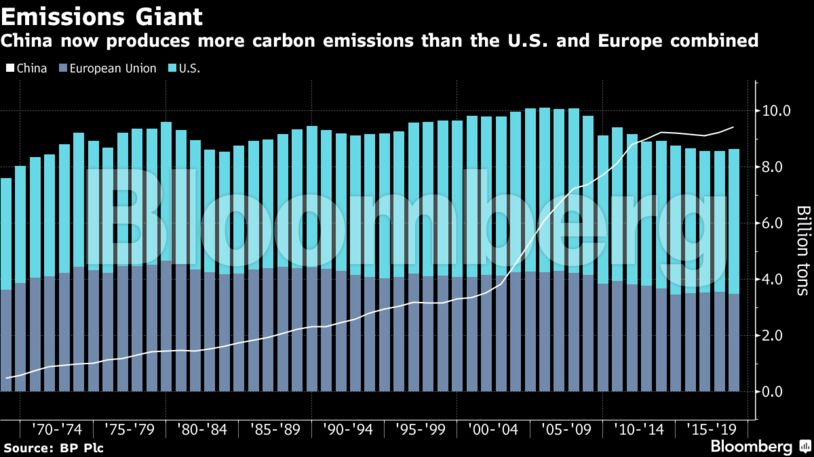

China was the world’s leading carbon emitter last year, pumping more than 9.4 billion tons into the atmosphere from the fuels it burned, more than the U.S. and European Union combined, according to BP Plc. While it’s too early to figure out the extent of the near-term reduction, the drop in energy use has been sudden and sharp.

China has stopped burning about 20% of the petroleum it normally uses as people avoid leaving home and airlines cancel scores of flights. Regions that are home to more than 850 million people have told businesses to extend their Lunar New Year holiday until Feb. 10, sapping demand for coal use in power plants. Steel mills, copper smelters and cement plants have reduced production as construction activity slows with workers unable to travel.

Some of that pollution will be lost forever — no one will drive to work twice a day later this year to make up for the lack of road trips now. In other cases, though, factories could maximize production later in the year to compensate for economic losses during the shutdown period, said Li Shuo, a policy adviser from Greenpeace China. He called the practice “retaliatory pollution.”

Citigroup Inc. forecasts slower economic growth than previously expected for the first half of the year, but has raised its estimate for the second half and sees a “major demand rebound” as the Chinese government eases policies to stimulate the economy. Wood Mackenzie Ltd. expects major hits to oil, coal and gas consumption in the near-term, but expects the same amount of economic growth, and therefore carbon emissions, over the course of the full year.

“This really just changes the shape of emissions this year rather than the net amount,” said Gavin Thompson, the consultancy’s Asia-Pacific vice chairman.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS