By Liam Denning

Core Laboratories NV, which offers services to enhance output from oilfields, dropped the ball early on Tuesday evening, or New Year’s Eve Eve if you will. It cut guidance for the quarter just about to end, issued underwhelming guidance for the quarter about to begin and, to cap it off, slashed its dividend by more than half. The latter was declared “sacrosanct” by management only two months ago — which, in hindsight, is one of those overwrought words that should set alarm bells ringing. Throw in Tuesday’s pre-drinking trading volumes, and the stock looks set to see out 2019 with a bang (not the good kind).

The ostensible reason for the sudden about-face is sluggish activity in international markets, which were hoped to offset the drag from the slowdown in U.S. fracking. The underlying reason is one that blends the oil business with New Year’s Eve seamlessly: the triumph of hope over experience.

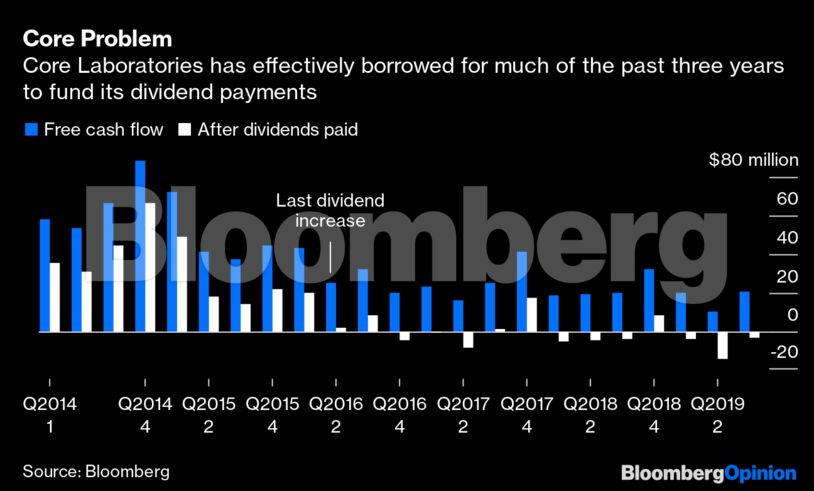

It is telling that Core Labs last raised its dividend in the second quarter of 2016, just after oil prices had bottomed out below $30 a barrel. At the time, the company anticipated a “V-shaped” recovery in commodity markets. But the seams were splitting. Shareholder equity had already dipped further into deficit in the first quarter of that year as dividends outpaced earnings. And a month after raising the dividend, Core Labs sold another $175 million of stock to help pay down its revolver.

In short, the company was paying a pre-crash dividend on post-crash cash flows in the hope that the inevitable swing up in oil prices would make it all balance out. Core Labs was certainly not alone in this thinking. But the oil market’s “V” turned out to be more a series of w’s.

Consequently, net debt to Ebitda has almost doubled since the middle of 2018, hitting 2.8 times at the end of September. By then, analysts were speculating about whether Core Labs would have to cut its dividend, just as they were back in early 2016. Yet analysts also remained bullish, with 16 recommending holding or buying the stock and just one advocating selling before Monday evening’s announcement.

In some respects, affinity for Core Labs is understandable. Capital intensity is low, and the company generates free cash flow consistently. Executive pay is also tied mostly to financial metrics. And, of course, Core Labs has striven to maintain the dividend.

The problem is that, in key respects, these perceived strengths rest on an anachronism. Compensation, while tied to financial performance, also remains tied overwhelmingly to relative rather than absolute performance — which doesn’t do much for shareholders in an energy sector this troubled. Meanwhile, sticking with a dividend is laudable only if it isn’t hollowing out your balance sheet and, as the risk premium rises, the stock price it ostensibly supports.

Core Labs has finally done the right thing but will inevitably pay a heavy price, at least in the short term. Beware oilfield services stocks as a whole, however, which are up almost a fifth this month on the back of a 10% rally in oil prices. Core Labs’ capitulation suggests the sector is about to undergo another round of warnings and cuts to guidance and forecasts as expectations of recovery get pushed out again.

One silver lining is that the oilfield services sector’s continuing woes indicate that recently-discovered discipline on the part of exploration and production companies may be sticking. This, in turn, would start to restore resilience to the contractors’ customer base and, by reining in U.S. supply, offer support to oil prices.

If that sounds like a lot of ifs and maybes strung together, that’s because it is. Core Labs’ cut closes out a decade in which the oil business in general stuck with a growth model relying implicitly on higher oil prices filling gaps in cash flow — while that same dash for growth undermined those oil prices. As most of us know from bitter experience, a truly happy new year begins with a little restraint beforehand.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS