By Elizabeth Low and Grant Smith

Futures held near $58 a barrel in New York after settling at the lowest since Dec. 3 on Wednesday. While the deal between Washington and Beijing promises increased Chinese purchases of American energy, and defuses some of the tensions that weighed on global markets last year, U.S. government data showed that combined inventories of crude and refined products rose to their highest since September.

West Texas Intermediate crude for February delivery slipped 2 cents to $57.79 a barrel on the New York Mercantile Exchange as of 8:22 a.m. local time. The contract fell 0.7% to close at $57.81 on Wednesday.

Brent for March settlement rose 8 cents to $64.08 a barrel on the ICE Futures Europe exchange after closing down 0.8% on Wednesday. The global benchmark crude traded at a $6.23 premium to WTI for the same month.

See also: Commodity Markets Shrug at China’s $95 Billion Purchase Pledge

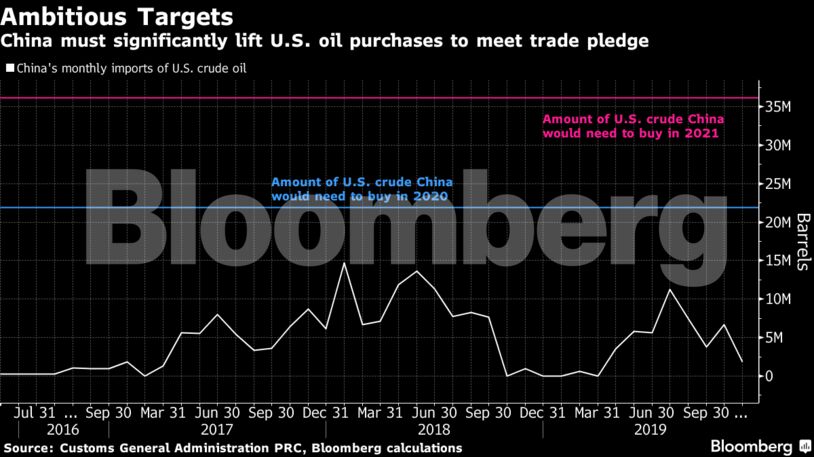

China pledged $52.4 billion of further purchases of American energy over 2020 and 2021, although it didn’t say whether it would lift a retaliatory 5% tariff on U.S. crude. The Asian nation, whose oil imports from the U.S. peaked at 14.7 million barrels in January 2018, would need to boost it to 21.9 million barrels a month this year and 36.2 million barrels in 2021 to fulfill the pledge.

“For oil, the situation really boils down to what this trade deal means for global growth, which remains to be seen,” Jeff Currie, head of commodities research at Goldman Sachs Group Inc., said in a Bloomberg television interview.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS