By Ann Koh and Grant Smith

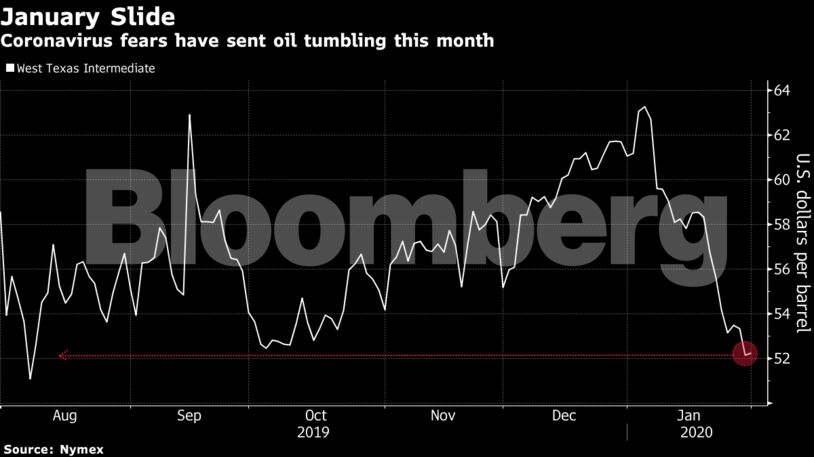

Futures were little changed in New York on Friday, after sliding to a five-month low on Thursday, as the World Health Organization declared the outbreak a global health emergency. Prices have slumped 14% in January as the disease locks down entire cities in China, the largest importer, and shows no sign of abating.

The rout has alarmed Saudi Arabia, prompting the biggest member of the OPEC cartel to push for an emergency meeting that could deepen production cuts already being made by the group. However, the overture hasn’t yet secured support from Russia, the most important player in a broader coalition known as OPEC+.

The oil market is “troubled by both rising demand worries and rising fuel stocks,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S in Copenhagen. “It’s going to take a firm commitment by OPEC+, or rising geopolitical tensions, to achieve a sustained recovery.”

West Texas Intermediate crude for March delivery traded up 5 cents at $52.19 a barrel on the New York Mercantile Exchange as of 10:26 a.m. London time. WTI is on course for the worst January since 1991.

Brent slipped 8 cents to $58.21 a barrel on the London-based ICE Futures Europe exchange, and is down around 12% in January.

Prices initially rose on Friday as the WHO said the virus doesn’t require travel bans, while a Chinese non-manufacturing purchasing managers’ index beat estimates.

| Other market drivers |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet