By Rakteem Katakey and Aaron Clark

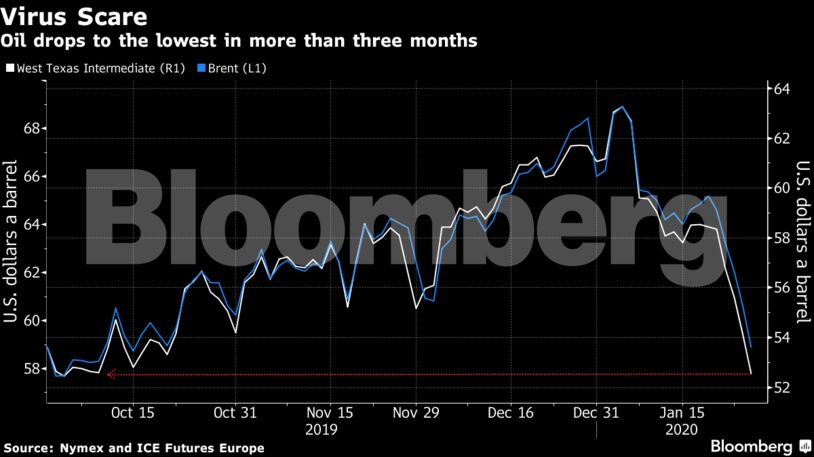

Futures plunged more than 3% as China reported an increase in fatalities and infections. While the country extended the Lunar New Year holiday to control the outbreak, more cases have been reported in other parts of the world. Goldman Sachs Group Inc. predicted that global oil demand may fall, but Saudi Arabia said it believes the crisis so far will have a “very limited impact” on consumption.

The virus is the latest upheaval for the oil market, which is has been struggling with demand concerns for months. Investors are selling crude and other commodities amid a broad withdrawal from riskier assets and fears the virus will curtail fuel consumption as travel is restricted.

“A supply glut of fuel in China would filter through to the rest of the world through exports and on that basis the market is reacting in this defensive manner,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “The Saudis can try to stem the sell-off but while its being driven by the need to mitigate losses that will be difficult to control.”

Brent futures lost as much as 3.6% to $58.52 a barrel on the London-based ICE Futures Europe exchange and traded at $58.69 as of 9:34 a.m. local time. The contract slid 6.4% last week, capping the longest run of weekly losses since June. West Texas Intermediate fell as much as 3.8% to $52.15.

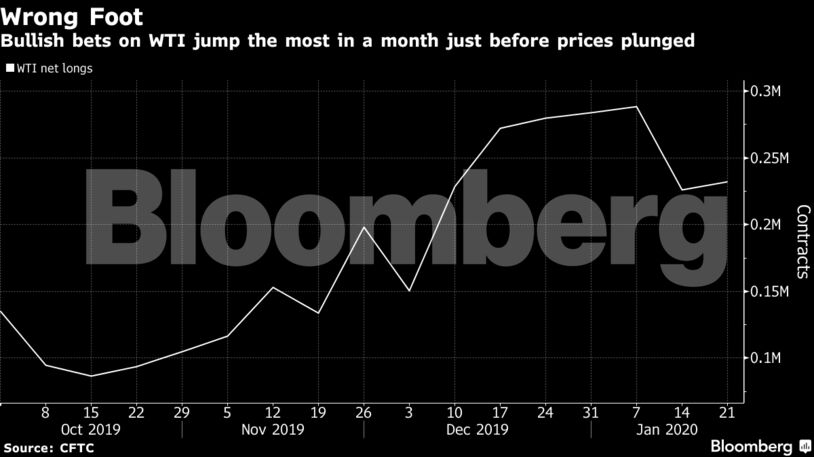

Hedge funds boosted bullish bets on WTI by 2.8% in the week ended Jan. 21, the most in a month, a day before prices tipped into the worst three-day slump since September.

Saudi Energy Minister Prince Abdulaziz bin Salman said the world’s largest oil exporter was monitoring the virus’s impact both on the Chinese economy and the oil market. Yet, he said that the same “extreme pessimism” that’s afflicting the market also occurred in 2003 during the SARS outbreak, “though it did not cause a significant reduction in oil demand.”

“The current impact on global markets, including oil and other commodities, is primarily driven by psychological factors and extremely negative expectations adopted by some market participants despite its very limited impact on global oil demand,” the minister said in a statement.

See also: Viral China: Behind the Global Race to Contain a Killer Bug

Global oil demand may slip by 260,000 barrels a day this year and could shave almost $3 from the price of a barrel of crude, Goldman Sachs said last week, using the 2003 SARS epidemic as a guide.

China extended the Lunar New Year holiday by three days until Feb. 2, while companies in Shanghai have been asked not to start work until at least Feb. 9. There are more than 2,700 confirmed cases of infection in China so far. Canada confirmed its first while the U.S. announced a fifth, as the virus spread to at least 15 countries and territories.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire