By Saket Sundria and Grant Smith

“After the demand optimism we saw regained at the end of last year, we believe that much more aggressive demand worries are about to enter the market, at least in the short term,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA.

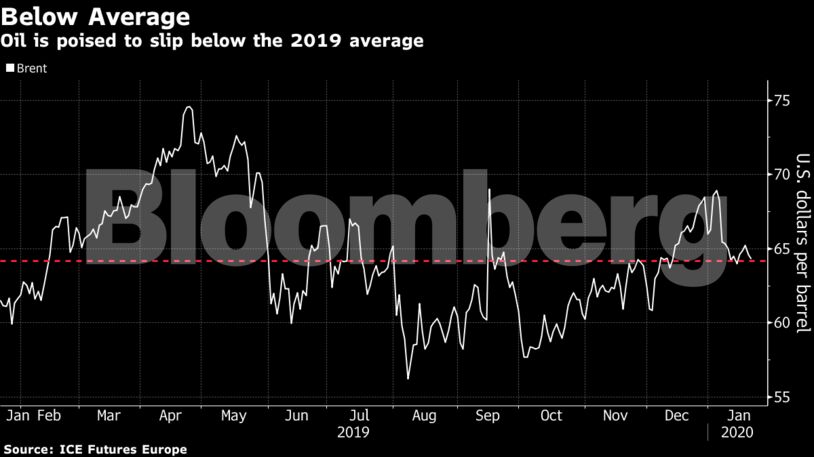

Oil prices are lower than at the end of last year as crises threatening supplies in OPEC nations Libya, Iran and Iraq — as well as the signing of a preliminary trade deal between the U.S. and China — fail to provide lasting support. With the U.S. shale-oil boom continuing, and being supplemented by offshore projects from the North Sea to Guyana, the world is “awash with oil,” according to the International Energy Agency.

See also: Coronavirus Could Bite Commodities If SARS Is Any Guide: Chart

West Texas Intermediate futures fell 67 cents to $57.71 a barrel on the New York Mercantile Exchange as of 9:02 a.m. local time. Brent for March settlement lost 66 cents to $63.93 a barrel on the London-based ICE Futures Europe exchange.

Oil demand may be curbed by 260,000 barrels a day on average if the outbreak spreads, Goldman said in a note, referencing the SARS impact in 2003 and translating that into a 2020 scenario. The peak travel season around Chinese New Year — which officially begins on Jan. 25 — “is a tremendous challenge, which could complicate the disease diffusion,” according to UBS Group AG.

Economists warned that China’s fragile economic stabilization could be at risk if authorities fail to contain the new virus sweeping across Asia.

Commenting on the 2003 SARS outbreak, economist Howie Lee of Oversea-Chinese Banking Corp. said “airports were empty, hotel occupancy fell drastically and it had an impact on the economy.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire