By Brian Eckhouse

The unsolicited bid by Brookfield is part of a years-long effort to diversify its portfolio and recycle capital by selling mature assets and acquiring new ones. The company has long been a hydropower player, with a capacity of around 7,900 megawatts. It’s recent M&A activity has boosted its wind and solar exposure.

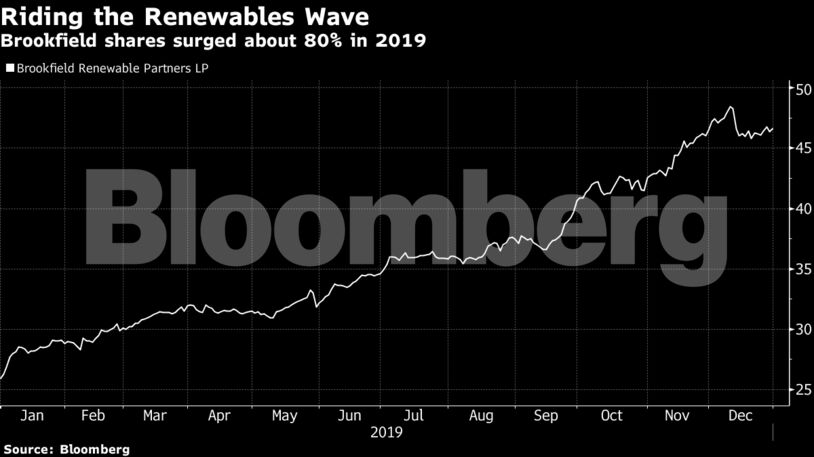

In the third quarter of last year, Brookfield agreed to acquire a 200-megawatt wind farm in China for $100 million with its partners. In July, it agreed to acquire a 50% interest in X-Elio, a global solar developer. Meanwhile, its shares surged about 80% last year, making it one of the best performers among North American renewables companies.

“It’s really a function of ‘do we feel like we can run a bigger, stronger company by simplifying the structure?’ Yes, absolutely,” said Sachin Shah, Brookfield Renewable’s chief executive officer, in an interview Monday.

Colin Rusch, an analyst at Oppenheimer & Co., said in a note Monday that he sees a “high likelihood” that the deal happens. TerraForm’s shares rose 10% to $17.16 in New York trading Monday while Brookfield fell 4.2% to $46.05.

Brookfield Renewable is “a best-in-class developer of long-dated renewable power and a savvy purchaser of distressed assets,” said Andrew Kuske, an analyst with Credit Suisse Group AG, in a research note.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire