By Sharon Cho and Grant Smith

West Texas Intermediate futures were little changed. U.S. crude stockpiles fell by 2.5 million barrels last week, a Bloomberg survey showed before government data due Wednesday. The White House is scheduled to put tariffs on a further $160 billion of Chinese goods Sunday, although Agriculture Secretary Sonny Perdue said they’re unlikely to be implemented. Chinese officials also expect the higher levies will be postponed, according to people familiar with the matter.

Oil closed at the highest level since mid-September on Friday after the Organization of Petroleum Exporting Countries and its allies surprised the market with deeper-than-expected output cuts. Attention has now turned back to the prolonged U.S.-China trade war and whether the two sides can nail down a much-hyped phase-one agreement.

“It is the uncertainty triggered by the trade tension that hindered risky assets gaining further ground,” said Tamas Varga, an analyst at PVM Oil Associates Ltd.

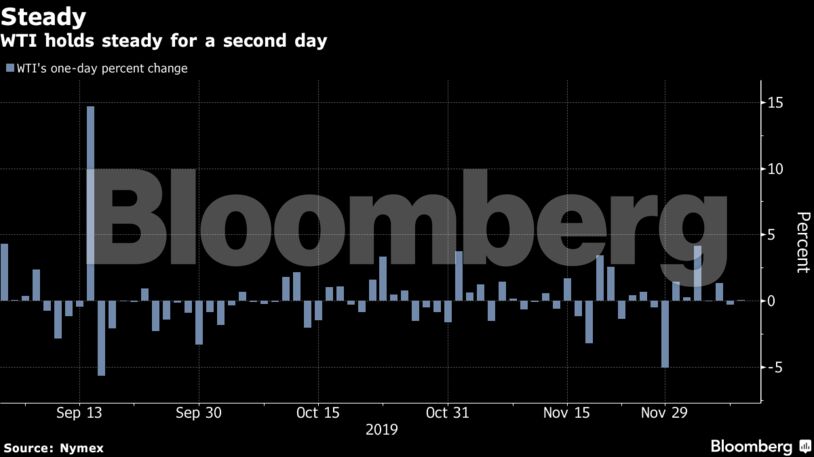

WTI for January delivery fell 11 cents to $58.91 a barrel on the New York Mercantile Exchange as of 8:43 a.m. local time. The contract closed 18 cents lower on Monday after jumping 7.3% last week.

Brent for February settlement declined 10 cents to $64.15 a barrel on the London-based ICE Futures Europe Exchange after slipping 0.2% on Monday. The global benchmark crude traded at a $5.31 premium to WTI for the same month.

See also: WTI Oil Options Volatility Slumps as Futures Drift Higher

It would be the second straight weekly drop in U.S. stockpiles if the Bloomberg survey is confirmed by Energy Information Administration data. Still, inventories are near the highest since mid-July after rising in 10 of the 11 weeks through Nov. 22.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS