By Bloomberg News It’s another reminder of the scale of the fight against climate change, as China accounts for about half the planet’s production and consumption of the fuel. Beijing has to balance supplying its population with affordable heat and power against its broader pledge to curb carbon emissions. China regularly tries to control imports to help domestic miners by limiting the amount of competing coal coming from overseas. What’s changed this year is that economic growth is slowing, and the attraction of cheaper foreign coal is likely to steer policy makers away from the repeat of 2018‘s curbs, which saw imports shut out almost entirely in the last weeks of the year to meet an annual quota.

A slowing economy due to the trade war with the U.S. is forcing companies to take a hard look at costs, according to Zhai Yu, a senior consultant at Wood Mackenzie Ltd. And China’s plan to lower electricity prices for industrial and commercial users by 10% this year is adding extra impetus to the search for cheaper fuel.

“Lower coal prices are needed to cut power prices,” said Zhai. “Imported coal has that advantage.”

But while its import policy is of keen interest for miners from major producers including Australia and Indonesia, it will still have a marginal impact on China’s overall use. Imports last year, for instance, were the equivalent of just 8% of domestic output. If imports sustain their pace of growth through the final quarter of the year, it puts them on pace to be the second-highest on record. China halted some coal cargoes at a major port in the summer after imports outpaced 2018 levels. And Australian coal has been subject to a go-slow on customs clearances that some observers have tied to political tensions with Canberra. But with only two months to go before the year is up, the prospect of a strict, nationwide clampdown on overseas purchases is fading fast.

“It’s hard to tighten imports in the last two months,” especially for power companies, said Wood Mackenzie’s Zhai. It normally takes about that time to complete a purchase from contract-signing to delivery, so firms will already have inked deals for overseas coal to be delivered in November and December, according to Zhai. Even the 2018 halt allowed waivers for companies that urgently required fuel to ensure ample power supplies for winter heating.

So, while China may yet halt custom clearances at ports where imports have risen significantly, the restrictions are unlikely to be as stringent as last year’s, Fenwei’s Zeng said. Notice of any curbs will probably be delivered verbally instead of in writing, he added, which may add to uncertainty.

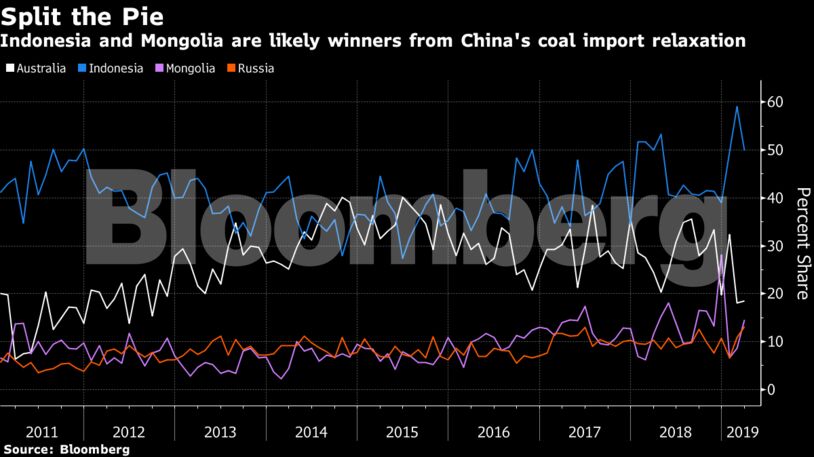

Australia’s Whitehaven Coal Ltd. said last week that the market is now speculating China may allow up to about 300 million tons of imports this year, from 281 million tons in 2018. Still, the winners from a relaxation of policy may be uneven, said Zeng. Suppliers from Indonesia and Mongolia could benefit more than Australian miners, whose relationship with Beijing remains cloudier despite protestations to the contrary from Canberra.

The import growth so far this year is partly due to domestic supply woes after a mine collapse in January in northern China’s Shaanxi province, said Ding Yihong, a chief analyst at Huaxi Securities. “Cheaper coal prices abroad have also been driving purchases from China,” he said.

The Australian benchmark for thermal coal has slumped 34% this year to $67.50 a ton. The domestic spot price at Qinhuangdao is down less than 2% to about $80.80 a ton.

Aussie Coal

Share This:

World’s Biggest Coal User Is Set to Boost Imports This Year

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire