By Jacquelyn Melinek

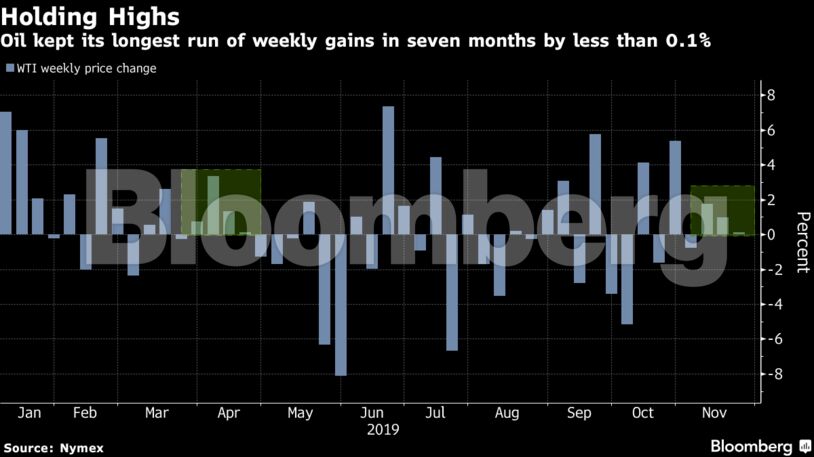

Futures slipped 1.4% in New York on Friday and rose 0.1% for the week, marking the third straight weekly increase. Trump said the the unrest in Hong Kong is a “complicating factor” in an interview on Fox News. Meanwhile, the dollar strengthened, diminishing the appeal of dollar-denominated commodities.

“What’s going to be important is any follow-through conversation or comments from the Trump administration regarding the trade deal and if there’s going to be anything to progress on that front,” said Josh Graves, senior market strategist at R.J. O’Brien & Associates LLC in Chicago. “There’s a lot of general skepticism right now.”

Oil has rebounded by about $5 since early October as fears of a potential global recession have receded, and on hopes for a breakthrough in the trade standoff. Yet, negotiations between Washington and Beijing have taken longer than expected, and concerns that surging U.S. supplies and constrained demand growth will unleash a new surplus have kept crude prices about 13% below this year’s peak.

“The first part of a trade war easing is yet to be agreed and has taken longer than expected, making markets fear that the deal would evaporate,” said Michael Poulsen, an analyst at Global Risk Management Ltd.

West Texas Intermediate for January delivery fell 81 cents to settle at $57.77 a barrel on the New York Mercantile Exchange. The third weekly increase marks the longest run of weekly gains in seven months.

Brent for January settlement lost 58 cents to close at $63.39 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.62 premium to WTI.

Trump wouldn’t say explicitly whether he’ll sign legislation backing Hong Kong’s protesters that passed unanimously in the Senate and with support from all but one Republican in the House. He’d been expected to sign the measure as soon as Friday.

“We were weak all morning and this inability to hold $58 is significant on a technical trading basis,” said John Kilduff, partner at Again Capital LLC in New York. Trump’s comments on China are “another negative concern for the market,” he said.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet