By Elizabeth Low and Grant Smith

While crude prices have picked up over the past month, they’re still down about 15% from the peak reached in April as the prolonged U.S.-China trade dispute saps an already-fragile global economy, crimping fuel demand. OPEC, which cut production this year to prop up the market, has signaled it’s unlikely to take stronger action to prevent a renewed glut in 2020.

“The market was none the wiser following President Trump’s speech,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. “Concerns over U.S.-China trade relations, as well as speculation around what OPEC might decide to do about supply cuts come early December, continued to linger.”

West Texas Intermediate for December delivery fell 45 cents, or 0.8%, to $56.35 a barrel on the New York Mercantile Exchange as of 9:04 a.m. local time.

Brent for January dropped 61 cents, or 1%, to $61.45 a barrel on the London-based ICE Futures Europe Exchange, and traded at a $5.05 premium to WTI for the same month.

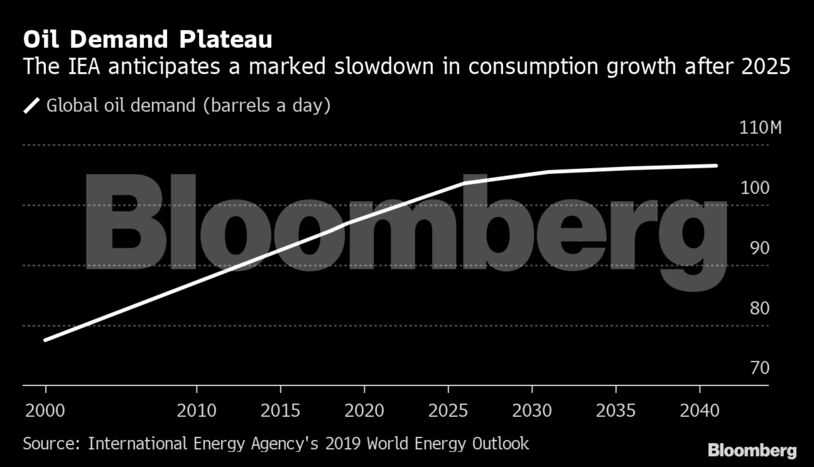

Read: Global Oil Demand to Hit a Plateau Around 2030, IEA Predicts

American crude inventories are forecast to have risen by 1.5 million barrels last week, according to a Bloomberg survey, adding to concerns over a looming supply glut. That would be the eighth increase in nine weeks if confirmed by official Energy Information Administration data due on Thursday. Stockpiles were at 446.8 million barrels as of Nov. 1, the highest since mid-July.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet