By Kevin Crowley

First and foremost, investors want to see how Hollub plans to service almost $22 billion of borrowing and $10 billion of preferred shares used to fund the acquisition, valued at around $55 billion when including debt.

“What the market really needs to hear is a clear path for paying down debt and getting the balance sheet in better shape at various crude prices,” said Noah Barrett, a Denver-based energy analyst at Janus Henderson Group Plc, which manages $360 billion including Occidental shares. “If crude prices pull back to sub-$50, does that screw up the whole delevering plan?”

Hollub’s pursuit of Anadarko made her the talk of the industry earlier this year. She jetted around the world to strike deals with Warren Buffett and Total SA CEO Patrick Pouyanne as part of a successful attempt to break apart an agreement Anadarko had signed with Chevron Corp., a rival five times bigger than Occidental. The acquisition completed in August was the industry’s biggest since Royal Dutch Shell Plc bought BG Group in 2016, and by far the largest-ever among shale explorers.

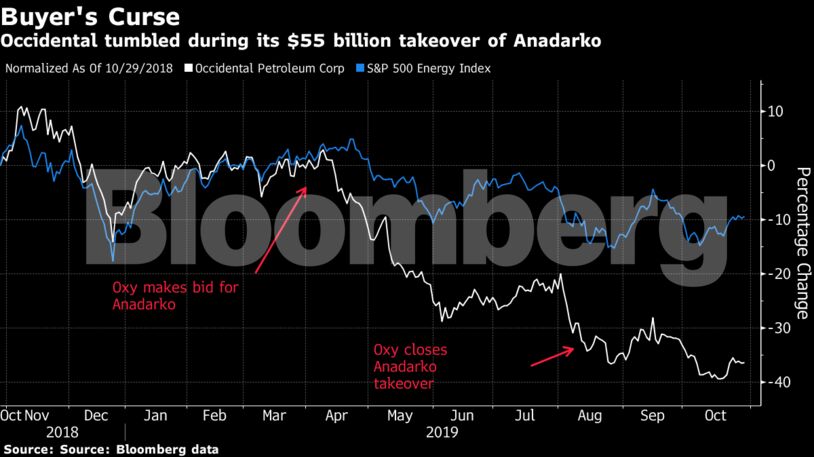

But so far Hollub’s feat has come at a huge cost to her investors, with the stock hitting an 11-year low last month. The $10 billion of preferred shares sold to Buffett’s Berkshire Hathaway Inc. came with an 8% dividend yield.

| Anadarko Takeover Funding | Amount | Yield |

|---|---|---|

| Term loans | $8.8 billion | 3% |

| Bonds | $13 billion | 3.1% |

| Berkshire shares | $10 billion | 8% |

| Total cash cost | $31.8 billion | 4.6% |

| Source: Occidental |

By 2021, Occidental expects to generate about $1 billion in excess cash after its dividend with West Texas Intermediate crude at $50 a barrel. That may be too long for many shareholders to wait.

Here are three developments that could help Hollub rebuild trust:

- Private equity firms including Blackstone Group Inc., Apollo Global Management Inc. and KKR & Co. are interested in buying Occidental’s Western Midstream Partners LP pipeline unit, people familiar with the matter said in September. The company, which has more than 15,200 miles of oil and gas conduits across the Midwest and Texas, has a market value of about $10 billion.

- Showing progress toward $3.5 billion of annual cost savings from the merger will also be key. The figure comprises $2.4 billion of capital spending cuts and $1.1 billion of overhead reductions.

- Improved well results are another important part of Hollub’s rationale for the deal. She’s betting Occidental could drill better wells than Anadarko to improve efficiency.

Occidental is scheduled to release its third-quarter results after the market closes on Monday. Hollub and her senior management will hold a conference call with analysts at 11 a.m. New York time the following day.

The shale giant is expected to post adjusted earnings of 38 cents per share, according to the mean of 24 analyst estimates compiled by Bloomberg. It has beaten expectations in all but one of the last 10 quarters.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann