By Kevin Crowley and Kelly Gilblom

1. Communication Breakdown

Royal Dutch Shell Plc Chief Executive Officer Ben van Beurden made an unplanned intervention midway through his company’s earnings conference call in an attempt to lessen the damage from its warning it may fall short of a share buyback target. The move only invited confusion and the shares slid.

Meanwhile, BP Plc backpedaled on Chief Financial Officer Brian Gilvary’s comment that a dividend raise would be premature, clarifying that “no decision has yet been made.” Exxon failed to field a senior executive on its call, a reversal from last year when the oil giant vowed to “increase engagement” with investors.

2. Reality Bites

Shell positioned itself as the sector’s cash king over the past two years after major projects came on stream and commodity prices rebounded from the crash. But with weaker economic growth threatening oil demand and crude supplies surging, Europe’s biggest oil company warned that it may not finish a $25 billion buyback program by the end of next year as planned.

Chevron has made financial discipline the keystone of its investment case with CEO Mike Wirth repeatedly saying “costs always matter.” It had previously warned of rising spending at its giant Tengiz field in Kazakhstan but few expected the estimated development cost to blow out by 25% to $45.2 billion, especially after upstream boss Jay Johnson said the project was making “good progress” in August. “Clearly this is a disappointment,” he said on Friday.

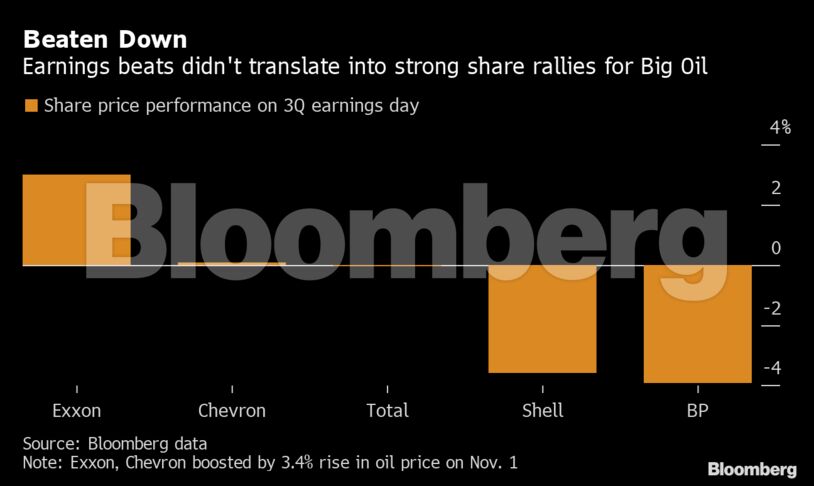

3. High Bar

Exxon, Shell, BP and Total SA all beat earnings estimates but their shares either fell or failed to keep pace with oil prices on the day. That underscores the fact that energy has a high bar to retain and attract investors as short-term commodity price constraints meet long-term uncertainties over the fate of fossil fuels.

In the U.S., energy companies make up just 4.3% of the S&P 500 Index, down from nearly 12% a decade ago.

4. Permian Power

One bright spot for Big Oil is the Permian Basin, which is now the fastest-growing major source of production for both Exxon and Chevron. BP is also gearing up to grow there after its $10.5 billion purchase of BHP Group Ltd.’s assets last year. Once an overlooked backwater, the Permian is now a safe space for America’s oil giants, providing quick, low-cost production.

Exxon is looking “very closely” at M&A in the basin and elsewhere, Neil Hansen, head of investor relations, also said Friday. Shell, meanwhile, appears to be cooling on the idea of expanding in the Permian; its CFO said it sees no need to buy a shale company.

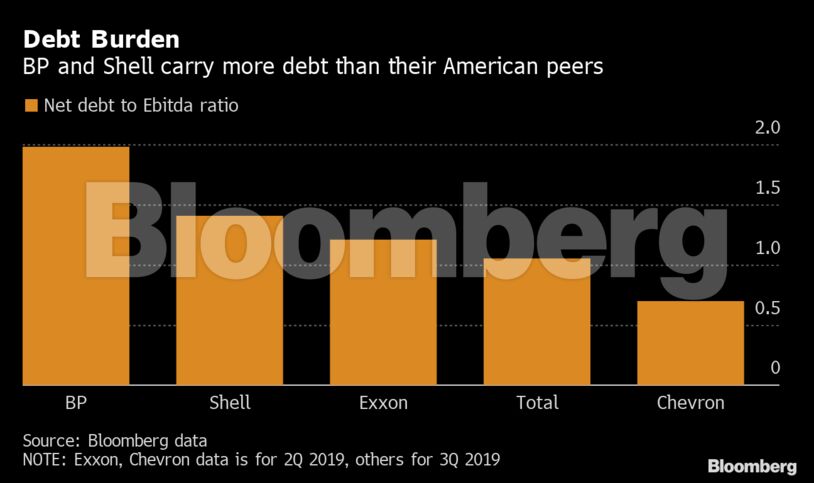

5. European Debt

Paying down debt is a much larger draw on cash reserves for European companies, especially BP, than for their American rivals. Reducing leverage is BP’s number one priority for extra cash at the moment while Chevron reiterated that dividends are its top consideration. That’s exactly what investors want to hear right now.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein