By Rachel Adams-Heard

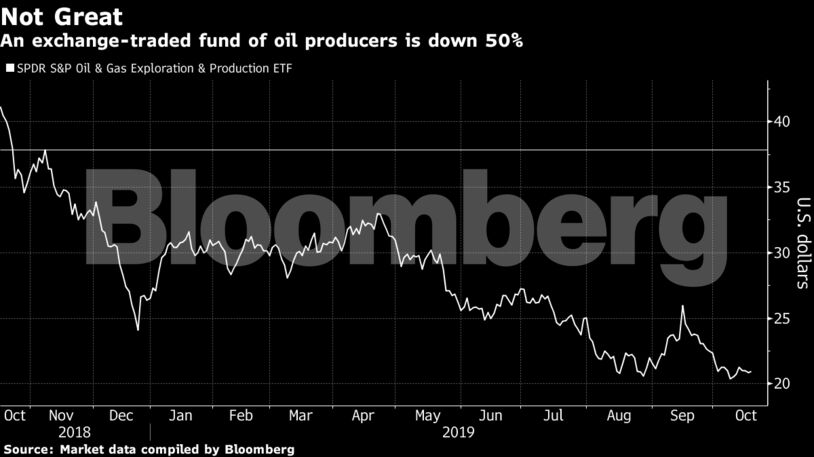

In the months since, an exchange-traded fund that tracks oil drillers has lost half its value, shale production growth has slowed, funding has gotten scarce and more than two dozen companies have collapsed into bankruptcy.

Things have changed for Loughrey, too. The 43-year-old former hedge fund manager no longer looks to invest the money himself. He ditched the fund and teamed with Michael Friezo, an ex-Credit Suisse Group investment banker who once gave him a job. They formed Chapel Hill, North Carolina-based Friezo Loughrey Oil Well Partners LLC, or FLOW, to advise others.

Loughrey’s sweet spot is the gap between expectation and reality when it comes to drillers’ projections of what their wells will actually produce. He uses data number-crunched from state records and applies assumptions he says are more realistic than those offered by companies in investor presentations.

As the shale boom decelerates, other data shops are selling similar services. They include Enverus, formerly known as Drillinginfo Inc., RS Energy and Rystad Energy.

‘Rosy View’

“Independent, unbiased analysis can shed a light of truth on management projections,” said Nick Volkmer, RS Energy’s vice president of intelligence. “It’s well-known that management teams are often compensated for production and reserves growth, incentivizing optimism and a rosy view of the future.”

One of Loughrey’s favorite targets is Apache Corp. and its flagship Alpine High oil discovery in West Texas.

Others have criticized Apache’s little-drilled corner of the Permian Basin because it promises more liquids-rich gas than the preferred, more expensive oil.

Apache touts a typical well there that would ultimately recover a stew of hydrocarbons that’s, at most, 15% oil.

Loughrey, however, says that in some places, Apache’s projections are about 80% too high.

“I think there should be a brouhaha about this,” Loughrey said.

Apache said it hasn’t reviewed Loughrey’s methodology and his work may include “exploratory wells” and “concept tests” that aren’t meant to optimize the company’s projections. The number Apache used in its most recent Alpine High presentation was initially published in October 2017, before the company had fracked any multi-well development pads, spokesman Phil West said in an email.

After drilling “a handful of large, multi-well, multi-zone pads at Alpine High,” the company is evaluating the play’s performance, West said. In the meantime, Apache suspended some activity there in response to low commodity prices.

Investors have largely written off Alpine High since Apache announced it three years ago. The company’s stock is down more than 60%, and a pipeline entity that serves the patch has lost three-quarters of its market value since it was spun off from Apache last year. The geologist credited with the Alpine High resigned last week, sending shares and bonds plummeting.

There’s More

Loughrey warns there are other companies that face a reckoning once their reserve estimates fail to pan out.

“Shale wells make money,” Loughrey said. “It’s a question of if the stocks will make you money.”

Data analysts working the shale patch can thank a quirk in federal oversight for their ability to build businesses based on providing investors with outside data.

The Securities and Exchange Commission sets strict criteria for what holdings oil companies can report as “proved reserves.” But forecasts pitched in press releases and investor presentations aren’t subject to the same restraints. Instead, explorers like to publicize so-called EURs, or estimated ultimate recoveries.

“That’s basically a petroleum-engineering term that means that, with all the data, what the well will ultimately recover,” said Dean Rietz, chief executive officer of reservoir engineering firm Ryder Scott Co. “But none of it may be reserves.”

Instead, those projections include “contingent resources” that can’t be profitably pumped under current conditions.

Optimistic expectations are compounded by assumptions about how close wells can be drilled to one another. Newer wells, called “child wells,” can sometimes interfere with output from the “parent well,” diminishing profits. But the risk of drilling them too far apart means leaving crude underground.

Diminished Output

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire