By Saket Sundria and Grant Smith

Oct 24, 2019, 6:28 AM

(Bloomberg)

Oil traded near $56 a barrel in New York as weak economic data from Germany added to concerns over slowing global fuel demand, tempering the boost from a surprise pullback in U.S. crude stockpiles.

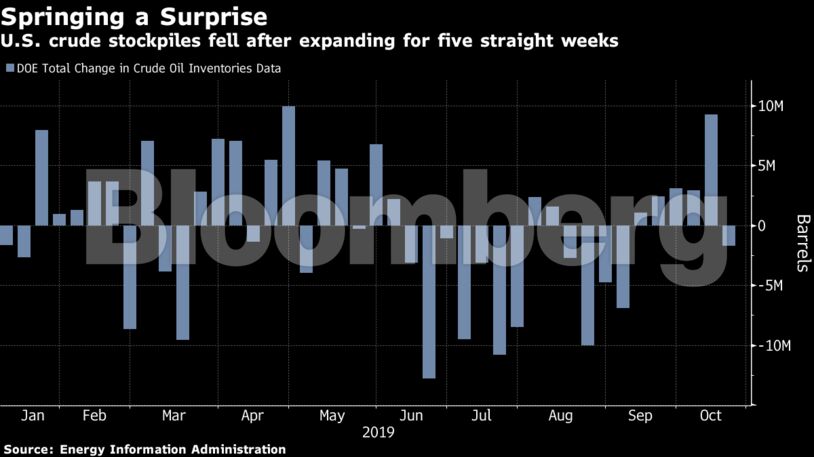

Futures recouped earlier losses of 1% as equities strengthened on positive corporate results, yet remained capped by economic worries as IHS Markit’s measure of German manufacturing and services signaled the nation’s slump will persist into the fourth quarter. Prices surged 2.7% on Wednesday — the biggest rally since Saudi Arabia’s energy facilities were attacked in mid-September — as American crude inventories unexpectedly shrank by 1.7 million barrels last week.

Oil is down 16% from an April peak as the prolonged trade dispute between Beijing and Washington dents global demand. That’s putting pressure on The Organization of Petroleum Exporting Countries and its partners to consider cutting production further when they meets in December. However, Russia’s Energy Minister Alexander Novak said on Wednesday that none of the OPEC+ members have submitted a proposal to change the existing terms of their deal.

“The soft economy remains top of mind and supplies look ample for the time being,” said Norbert Ruecker, head of economics at Julius Baer Group Ltd. in Zurich.

West Texas Intermediate for December delivery was 2 cents lower at $55.95 a barrel on the New York Mercantile Exchange as of 8:01 a.m. local time. The contract added $1.49 to close at $55.97 on Wednesday, the biggest gain since Sept. 16.

Brent for December settlement rose 5 cents to $61.22 a barrel on the London-based ICE Futures Europe Exchange. The contract added $1.47 to $61.17 on Wednesday. The global benchmark crude traded at a $5.27 premium to WTI.

See also: Andurand Heads for Second Annual Loss Despite October Gain

Total U.S. stockpiles of crude and oil products, excluding the strategic petroleum reserve, fell by 9 million barrels last week to the lowest level since May, according to the Energy Information Administration released on Wednesday. Gasoline inventories dropped for a fourth week as demand for the motor fuel rose to its highest since at least 1991 on a seasonal basis. Imports of foreign oil slid to the lowest in more than two decades.

Demand woes still persist in Asia, the biggest consumption center for oil. South Korea’s economy grew at a slower pace in the third quarter, while China last week reported a slump in the pace of economic growth to the lowest since the early 1990s.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire