By Sharon Cho and Alex Longley

The deteriorating U.S. economy — and more signs of weakness in China and Germany — is worsening what was an already fragile consumption outlook for fuels. OPEC member Nigeria warned Thursday that oil demand will be “very challenging” next year. These concerns and a quick return of Saudi Arabian production have evaporated oil’s gains following the Sept. 14 attacks on the kingdom.

“Oil markets are focusing on severe macro risks, but are also shrugging off the most heightened geopolitical risk in years,” Citigroup Inc. analysts including Ed Morse wrote in a report. “As markets shed just about any consideration of supply risk, attention stays focused on what is nearly universally expected to be a significantly weaker year of demand growth.”

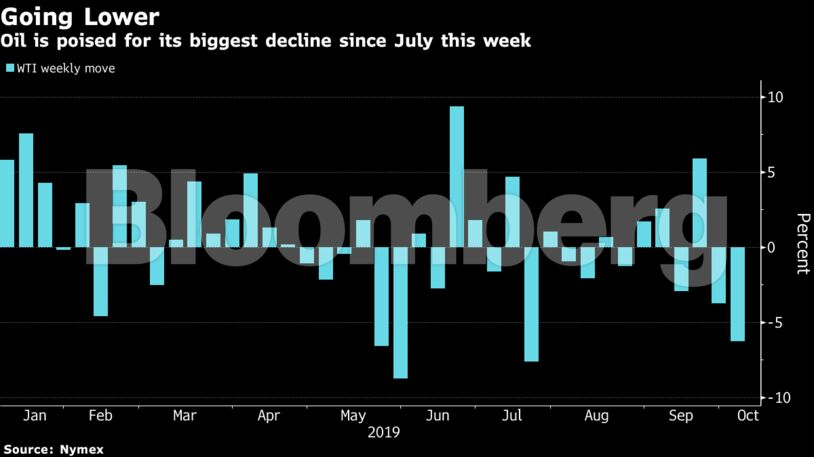

West Texas Intermediate for November delivery rose 25 cents, or 0.5%, to $52.70 a barrel on the New York Mercantile Exchange as of 11:06 a.m. in London.

Brent for December increased 0.8% to $58.19 a barrel on the ICE Futures Europe Exchange, and is down 6.1% for the week. It traded at a $5.57 premium to WTI for the same month.

READ: U.S. Oil Now Costs $12 Million to Ship After China Sanctions

A key U.S. factory index fell to a 10-year low on Tuesday as businesses held back investments amid tariffs and the U.S.-China trade war. That was followed by data Wednesday showing hiring at U.S. companies cooling, while quarterly sales figures from automakers such as Ford Motor Co. are adding to the concern.

Washington and Beijing are set to restart high-level trade negotiations next week, but the chances of a short-term breakthrough don’t appear to be high. Meanwhile, the U.S. imposed tariffs on European goods including aircraft and dairy products this week.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire