By Alice Gledhill and Alexander Weber

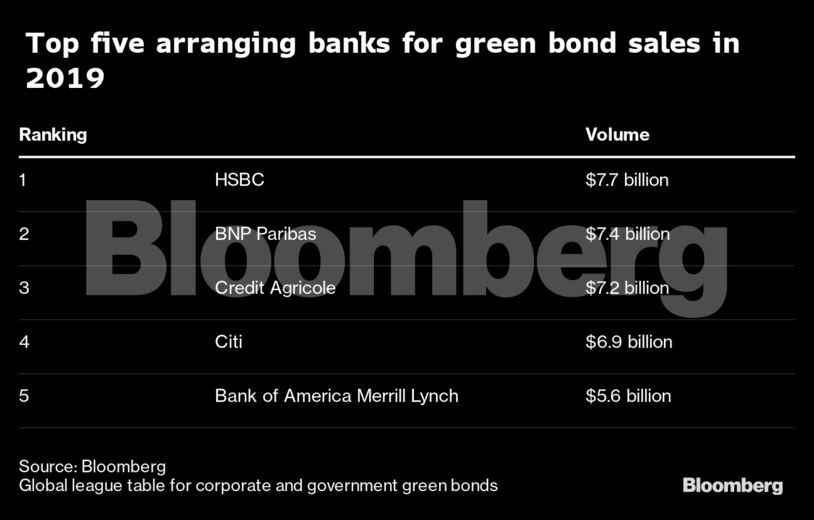

“I do think this is a new battleground,” said Farnam Bidgoli, head of sustainable bonds for Europe the Middle East and Africa at HSBC, which has sold more of the debt than any other bank this year. “All the banks are setting up sustainable finance teams.”

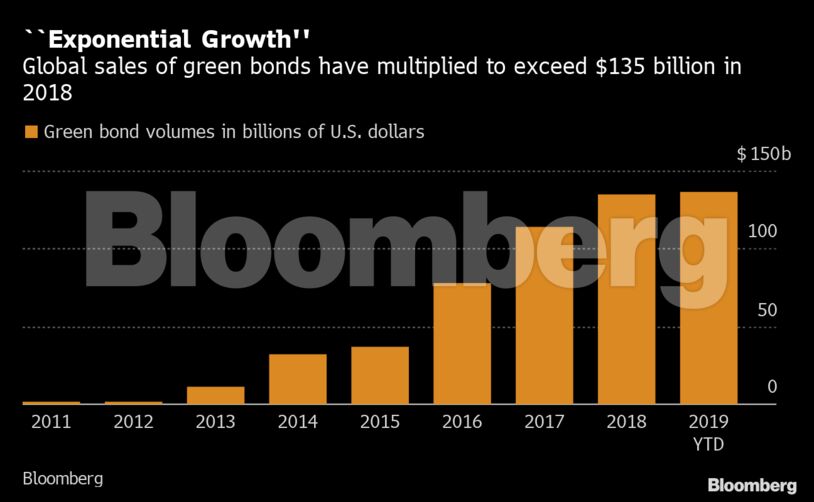

As banks grapple with a slowdown in traditional engines of growth such as lending and trading, they’re seeking to capitalize on a boom in green finance. Global green-bond sales have already beaten last year’s record $135 billion well before the end of 2019. Issuance of the securities has more than quadrupled in the past five years, according to data compiled by Bloomberg.

The sales boom is being driven by corporations and governments raising funds to invest in initiatives to help them meet commitments to cut fossil fuel use, embracing principles of The Paris Agreement on climate change.

The biggest users of the market are sovereign borrowers, such as France which has issued around $4 billion in green bonds this year.

France is a prominent supporter of international initiatives to tackle climate change, including the European Union’s objective to achieve at least 40% cuts in greenhouse gas emissions from 1990 levels by 2030.

But corporations are catching up. Companies now dominate overall issuance, even if the individual transactions are smaller in size than sovereign deals. Sovereign borrowers’ share of the new bond volumes has shrunk to 29% this year. Five years ago, they accounted for more than half the market.

Telecoms groups such as Vodafone Group Plc and Verizon Communications Inc. aiming to reduce energy consumption alongside power firms funding renewable energy investments like E.ON SE and Iberdrola SA, are among prominent corporate issuers this year.

This “exponential growth” is driven by demand from investment funds that are increasingly likely to seek assurances on the environmental or social credentials of what they are financing, according to HSBC’s Bidgoli, who expects similar growth rates at least until 2021.

“Demand from investors continues to exceed the issuance that you see,” she said.

That’s left banks moving to expand their green bond businesses quickly.

Goldman Sachs Group Inc. created a “sustainable finance group” earlier this year, charged with finding ways to address demand from investor and corporate clients.

Other lenders have also hired debt capital markets bankers to drive expansion in the market. Nomura Holdings Inc. last year appointed Jarek Olszowka as head of sustainable finance, a newly created role. BNP Paribas SA appointed Chaoni Huang as Asia-Pacific head of sustainable capital markets in July, also a new role.

Explosive demand for green finance has so far had little effect on the cost of borrowing because record low interest rates are squeezing yields across all classes of debt.

“Some issuances have priced better than non-green bonds but by and large these differences are quite small,” said Jon Williams, a partner at PwC specializing in sustainability and climate change.

In a relatively young market it remains difficult to quantify the impact of this type of financing and its contribution to reducing carbon emissions. The sector also faces a challenge from uncertainty over what constitutes a “green” deal. Currently, the label does not depend on a set of legally binding rules. Borrowers often structure the bond offerings according to voluntary guidelines compiled by bodies like the International Capital Market Association.

“I’ve looked at issuances that have been said to be green and I would just say they are less brown,” said Williams. “Certain projects just really haven’t got their green standards robust enough.”

But for now, the tide is still rising. Assets under management at 644 funds focused on environmentally friendly investments tracked by Bloomberg stand at more than $220 billion, compared with around $80 billion at the end of 2014.

“Today you cannot talk to any bond issuer or investor without this environmental, social and governance angle factored in,” said Agnes Gourc, head of green bonds at BNP Paribas, which has jumped to second from 17th in Bloomberg’s green bond rankings over the past three years. “As a bank, I don’t think you can operate effectively without it.”

Read More:

- Here’s How ‘Green Finance’ Aims to Save the Planet: QuickTake

- What Are Green Bonds and How ‘Green’ Is Green?: QuickTake

- These Bonds Can Turn Brown Companies Green: QuickTake

- How to Tell If Your Investment Is Really Responsible: QuickTake

(This story is part of Covering Climate Now, a global collaboration of more than 220 news outlets to highlight climate change.)

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS