By Julian Lee

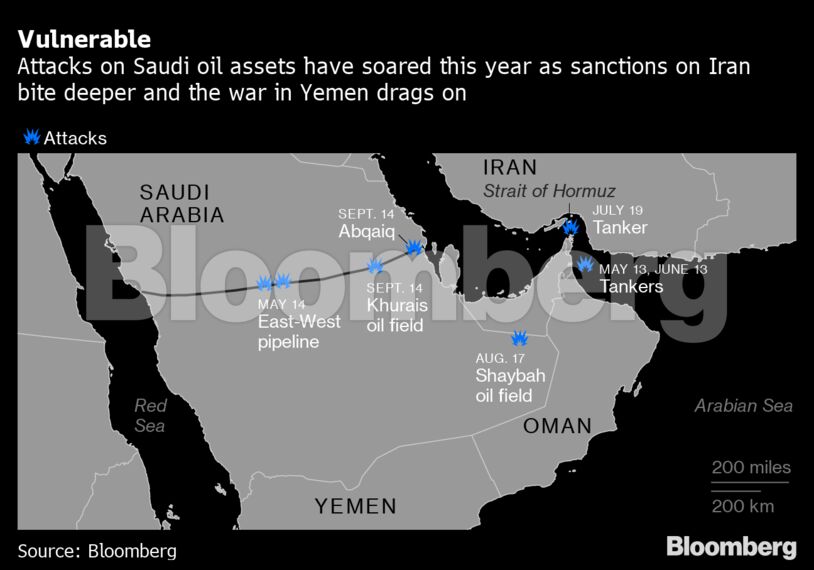

If the attack was indeed launched from Iran, that raises very serious questions about the ability of Saudi Arabia’s expensive air defense systems (or the people using them) to defend the most important oil installation on the planet. The failure to detect 25 incoming threats travelling 280 miles from the direction of your sworn enemy would be a major failure. Missing them from an unexpected direction would be easier to understand, although no less devastating.

The damage to infrastructure will be repaired. The Khurais field resumed 30% of its output within 24 hours, pumping about 360,000 barrels a day, and the Abqaiq plant was processing 2 million barrels a day by Tuesday, down from 4.5 million before the strikes. The kingdom’s production capacity will be restored to 11 million barrels a day by the end of the month and in full by the end of November, according to the new energy minister Abdulaziz bin Salman. Some independent analysts see it taking longer. Energy consultants FGE said the Saudi plans were optimistic, while Rystad Energy said repairs at Abqaiq may only be completed “as we approach the end of the year.”

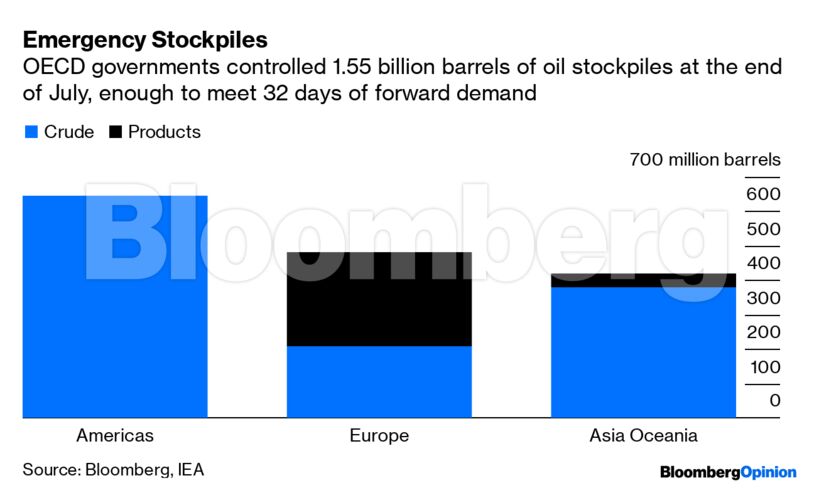

The disruption will be offset initially by increased production from Saudi fields that don’t rely on Abqaiq or Khurais for processing, by drawing on the kingdom’s own reserves at home and overseas, and through increased production from other countries. Emergency stockpiles in oil-consuming countries may be tapped if necessary, although the International Energy Agency doesn’t believe they will be needed.

But Saudi Arabia’s 12 million barrels a day of maximum sustainable capacity has just lost its effectiveness as the world’s hydrocarbon security blanket.

Strategic stockpiles held by oil-consuming countries have only ever been a sticking plaster, designed to get us through a short supply interruption while Saudi Arabia boosts output. But last Saturday’s attack has, at a stroke, taken out much of that spare capacity along with current supplies.

What the world needs now is an outbreak of peace, or at least “live and let live,” in the Middle East. Unfortunately that seems as unlikely as ever. Demonizing Iran or any other country won’t reduce tensions even if it’s a natural reaction to the strikes.

In the absence of political calm, clearly there needs to be an extensive upgrade to the protection of key assets — although that might not thwart a repeat attack.

Holding all of the world’s spare production capacity in one place has always been a risk. A broader system of allocating and paying for an output buffer across different geographies may be desirable, even for the U.S., which remains a net importer of oil. With international institutions losing their luster, however, I don’t hold out much hope.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire