By Heesu Lee and Alex Longley

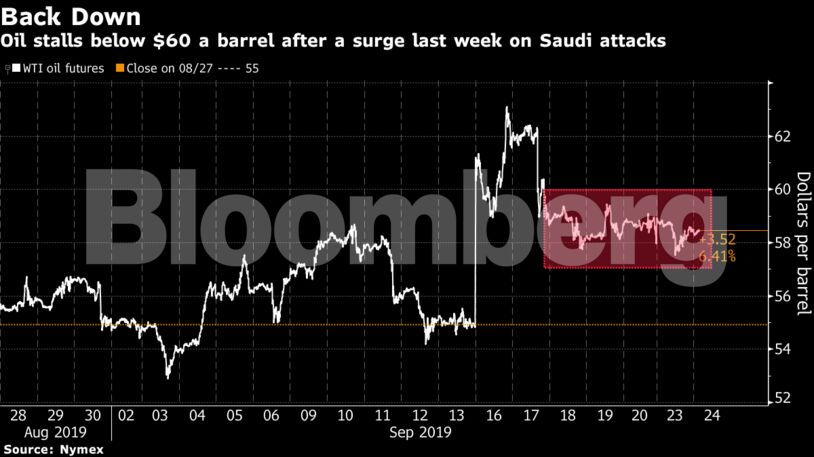

Oil is still heading for the biggest monthly gain since June following the attacks that took out 5% of global supply and spurred a record spike in prices. The U.S., France and the U.K. have all blamed Iran for the strikes, meanwhile America is moving more weapons and troops to Saudi Arabia. While the kingdom has reiterated its commitment to restore output to pre-attack levels by the end of September, some analysts are skeptical that target can be reached.

“It is surprising that fears of further attacks, either on Saudi Arabia or on its Middle East allies or retaliatory strikes on Iran, have subdued,” PVM Oil Associates analyst Tamas Varga wrote in a report. The geopolitical risk premium in crude is currently “curiously non-existent,” he said.

See also: Flash-Bang Oil Rally Fizzles as Demand Fears Balance War Risk

West Texas Intermediate for November delivery dropped 59 cents to $58.05 a barrel on the New York Mercantile Exchange as of 10:32 a.m. London time. Brent crude for November slipped 72 cents, or 1.1%, to $64.05 a barrel on the ICE Futures Europe Exchange. The global benchmark crude traded at a $5.99 premium to WTI.

State-run Saudi Aramco reduced refinery run rates by 1 million barrels a day after the attacks to make more crude available for export. The kingdom’s oil inventories are down 8.4% since the strike, according to Orbital Insight.

If Energy Information Administration data Wednesday confirms the expected decline in U.S. crude stockpiles, it would be the fifth weekly draw in six weeks. Inventories rose by 1.1 million barrels to 417.1 million barrels in the week ended Sept. 13, according to the EIA.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS