By Alex Longley

(Bloomberg)

Oil extended its advance as U.S. stockpiles were estimated to have dropped and OPEC+ members gathered in the United Arab Emirates ahead of meetings this week.

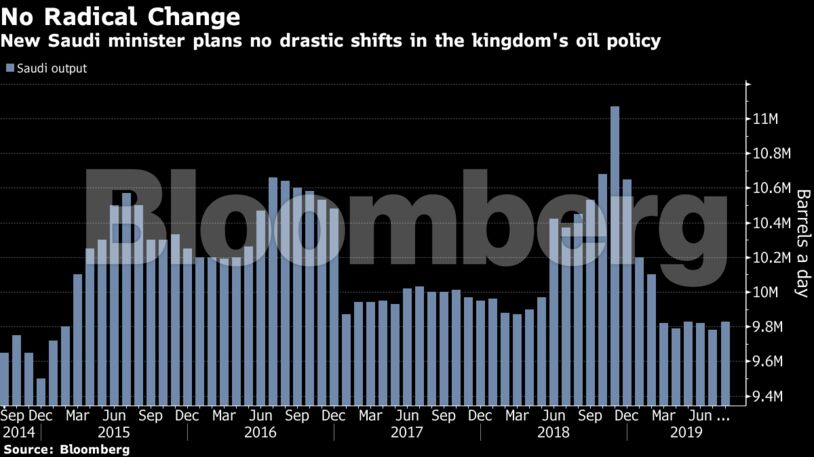

Futures rose for a fifth day in New York, the longest run of gains since late July. U.S. crude inventories probably declined by 2.8 million barrels last week, according to a Bloomberg analyst survey before government data due Wednesday. In Abu Dhabi, new Saudi Energy Minister Prince Abdulaziz bin Salman signaled a continuation of the kingdom’s policy of output restraint.

Crude is still down more than 10% from its peak in April as a prolonged U.S.-China trade war dents the demand outlook. Nevertheless, this Thursday’s meeting of the OPEC+ Joint Ministerial Monitoring Committee in Abu Dhabi, as well as Prince Abdulaziz’s commitment to maintain Saudi policy, are keeping the market focused on production curbs.

“The focus is going to be on the macro oil picture; it is going to be on the JMMC meeting,” said Olivier Jakob, managing director of consultants Petromatrix GmbH. “The new Saudi energy minister has not said anything that deviates from the previous policy.”

West Texas Intermediate oil for October delivery advanced 50 cents, or 0.9%, to $58.35 a barrel on the New York Mercantile Exchange as of 8:22 a.m. New York time.

Brent for November settlement rose 56 cents, or 0.9%, to $63.15 a barrel on the ICE Futures Europe Exchange. The global benchmark oil traded at a $4.86 premium to WTI for the same month.

“There is nothing radical in Saudi Arabia; we all work for the government, one person comes one person goes,” Prince Abdulaziz said at the World Energy Congress in Abu Dhabi on Monday, his first public comments since he was appointed. Saudi Arabia has shouldered the bulk of OPEC+ production cuts, and is pumping about 500,000 barrels a day less than its agreed cap.

This week sees the publication of three key monthly market reports. The U.S. Department of Energy will publish its Short-Term Energy Outlook later on Tuesday, while the Organization of Petroleum Exporting Countries will release its report on Wednesday and the International Energy Agency’s review is due Thursday.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire