By Grant Smith and Sharon Cho

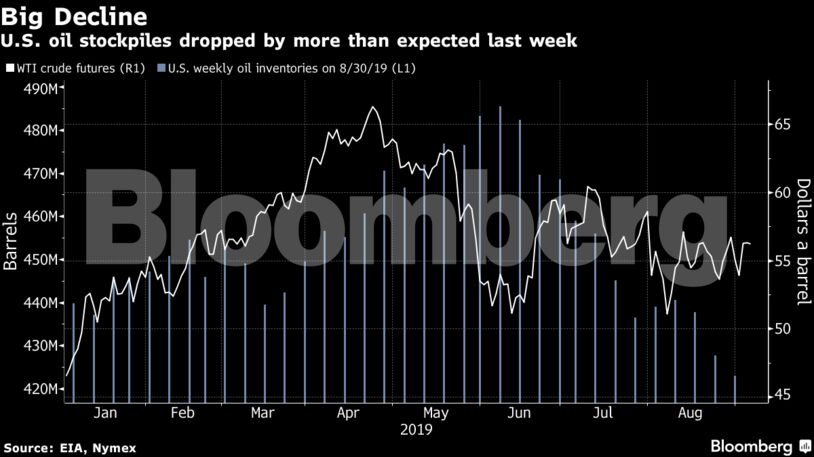

Futures dropped 2% in New York, erasing all gains for the week. Prices had touched a one-month high on Thursday after American inventories slid by 4.77 million barrels, more than twice what analysts had expected. Yet despite the prospect of easing trade tensions as the U.S. and China plan face-to-face negotiations next month, Commerzbank AG and UBS Group AG said on Friday that their expectations for prices had weakened because of the economic gloom.

“As much as the U.S. rebalancing process is gaining traction, there is still no getting away from lingering demand-side concerns,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

Crude has been volatile in recent weeks as the tit-for-tat tariff war between the world’s top two economies worsened, fueling concerns oil demand may be dented further. Commerzbank cut its Brent crude forecasts by $5 a barrel, predicting that the grade will average $60 through to the end of next year, while UBS said the “deteriorating” outlook would pressure the benchmark down to $55.

West Texas Intermediate oil for October delivery fell $1.14 to $55.16 a barrel on the New York Mercantile Exchange as of 7:17 a.m. local time. Brent for November declined $1.30 to $59.65 a barrel on the ICE Futures Europe Exchange. The global benchmark crude traded at a $4.62 premium to WTI for the same month.

See also: EIA Stockpiles Drop on Driving Season’s Last Hurrah: Julian Lee

U.S. crude inventories fell for a third week to about 423 million barrels in the period ended Aug. 30, dropping to the lowest level in more than 10 months, according to data from the Energy Information Administration. The median estimate in the Bloomberg survey forecast a 2 million barrel decline.

Chinese Vice Premier Liu He agreed to a visit in “early October” during a telephone call on Thursday with U.S. Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer, according to a statement from China’s Ministry of Commerce. A meeting would take place against the threat of increasing American tariffs on Chinese goods, as President Donald Trump’s administration is set to ratchet up levies on Oct. 1 and again in December.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS