By Liam Denning

So I contacted STR, a research firm and consultancy that tracks these data for the hotel and tourism industries. Looking at Midland and its neighbor Odessa together, the average rate for hotel rooms in August was just under $130 a night (before tax), according to STR’s data. That’s down from about $138 in March. That doesn’t seem like a big drop – except for three important things.

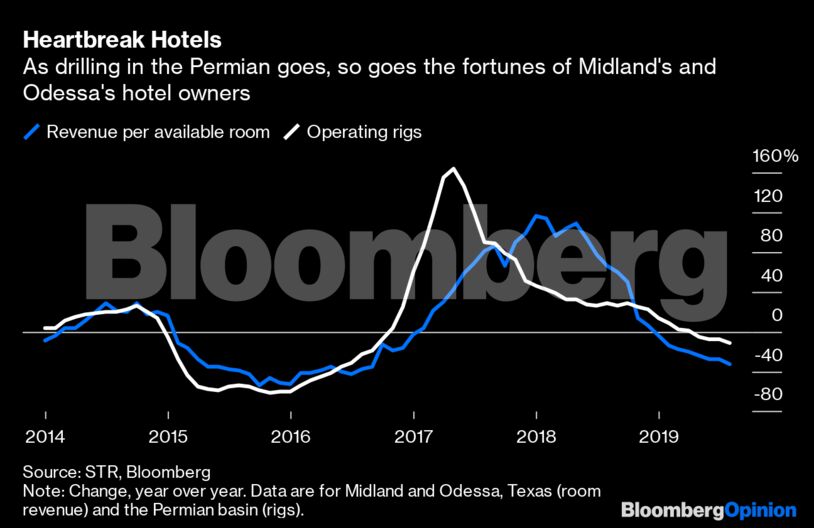

First, my financial contact’s experience could have represented an extreme; if you want the last room available and have no other options, then prepare for surge pricing (which is also how the oil market works, aptly enough). Second, these are averages. And third, when looking at hotel economics, we also need to factor in occupancy rates, using a metric called “revenue per available room.”Here is how Midland and Odessa look on that number:

Analysts would typically look at how this number changes year over year to get a sense of how a particular market is doing. And this is where the downswing really becomes apparent. Revenue per available room was down 32%, year over year, in August; and down 21% for the year to date. Double-digit changes in either direction are “very, very rare,” says Jan Freitag, a senior VP at STR, noting the figure for the U.S. as a whole, year to date, is a rise of just 1.1%. Talking about the Permian twin cities’ big moves, he added: “Normally, you get that when something like a hurricane hits; like a natural disaster.”

A disaster of sorts does appear to be unfolding in the Permian, which, while thankfully not of the natural kind, is inflicting pain nonetheless.

It has been almost two weeks since an attack on Saudi Arabian oil facilities took 5% of the world’s supply off the market temporarily –and, more importantly, reminded us how vulnerable this system really is. Yet Nymex crude futures are up less than $2 a barrel since then; swaps for 2020 are up less than a buck. This is a market so apparently saturated – with oil, talk of trade war and sheer despondency – that even the unthinkable hasn’t roused it.

More to the point, the exploration and production sector now actually trades below where it was that Friday before the missiles began flying. For all the productivity gains in U.S. shale over the years, frackers, particularly smaller and mid-cap producers that typically have higher unit costs and shallower pockets, are struggling to balance drilling budgets and demands for payouts from long-suffering investors. In the latest quarterly survey of energy firms by the Federal Reserve Bank of Dallas, the second biggest constraint on near-term growth cited by Permian operators, after oil and gas prices, was pressure from investors for free cash flow.

All this is why those hotel rooms in Midland and Odessa are so cheap. Just take a look at this chart:

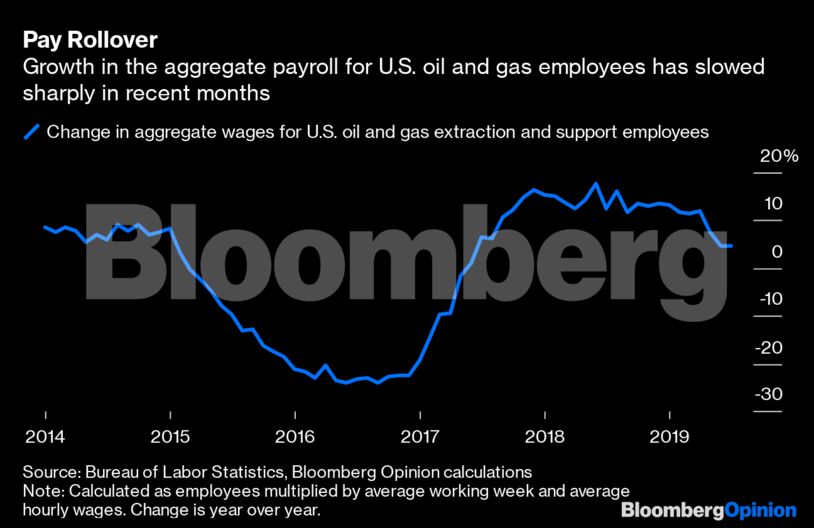

Employment in the oil and gas sector, while still up year over year, has flattened out since January. The aggregate payroll (in terms of estimated dollars paid) is still rising in single digits but has slowed dramatically. At a more local level, jobs in the Permian basin rose by just 0.1% in the first seven months of the year, lagging Texas as a whole for the first time since 2016, according to the Dallas Fed.

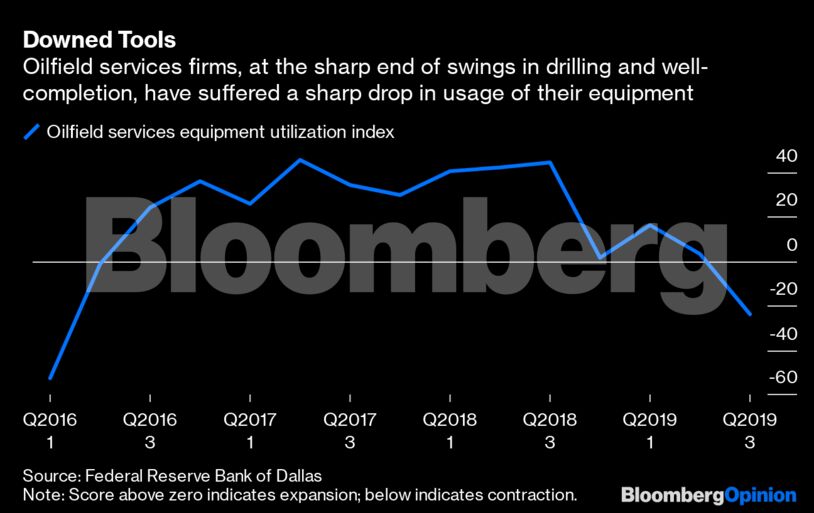

Layoffs in the Permian basin are likely to accelerate, and soon. There were 417 rigs operating there at the end of last week, down 15% from last November, when oil (and oil equities) began to collapse. The rig count fell below 150 in the depths of the crash in early 2016. While a drop of that magnitude isn’t necessarily in the cards, it could easily fall well below 400. Only 2% of respondents to the Dallas Fed’s survey thought the U.S. oil rig count reached its low point this quarter; 68% don’t expect it to bottom out until sometime between now and next June. Notably, the equipment utilization index for beleaguered oilfield services firms – an indicator of activity in the shale basins – hit its lowest level this quarter since the trough of early 2016.

With prices moribund and investors more interested in getting cash than giving it these days, the squeeze on Permian operators and employees (and hotels) is on, until higher energy prices or (more likely) consolidation come into play. One respondent to the Dallas Fed’s survey summed it up best:

The capital markets remain problematic. Access to capital will crimp the industry. It feels like employment in the sector will be decently lower in the next 12 months.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire