By Noah Smith

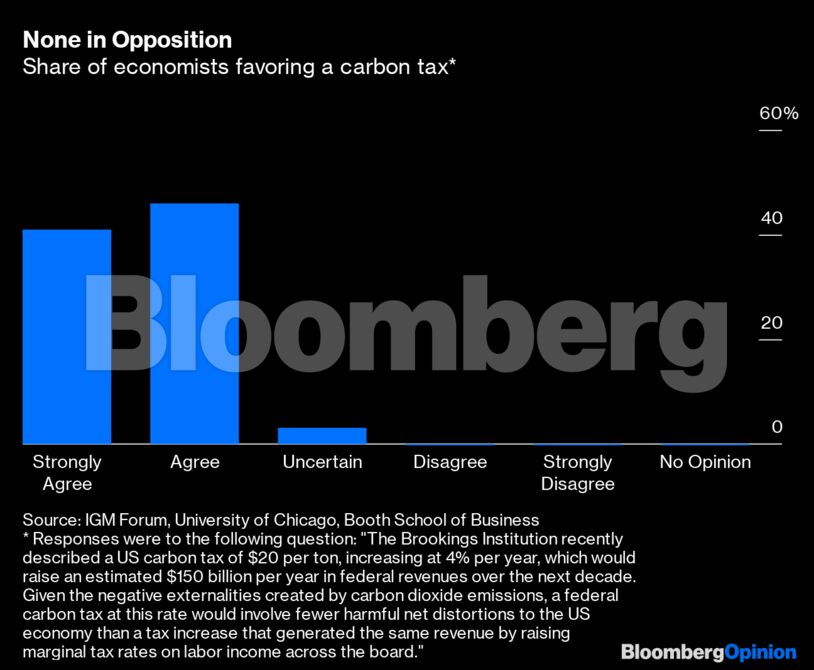

Many economists believe they have an elegant and simple way to do this: a carbon tax. Earlier this year, a large group of economists from across the ideological spectrum issued a statement calling for a tax on atmospheric carbon dioxide emissions, with the proceeds paid out to all Americans in the form of a dividend. For years, surveys of top economists have found strong support for such a policy:

The logic behind the idea is simple. Every ton of carbon released into the air adds to global warming by a certain amount. This causes a certain amount of harm to the public; economists call this the social cost of carbon. Basic economic theory says that the government should deal with this by estimating this cost and setting the tax equal to the harm caused. It’s clean, it’s elegant and it doesn’t require the government to start mucking around in the grubby details of things like renewable-energy mandates.

There’s a big problem, though – a carbon tax almost certainly isn’t enough to get the job done.

First, estimating the social cost of carbon is extremely difficult. Economists have to take into account all the possible harms that might come from global warming – floods, crop failure, loss of coastal property, wildfires, droughts, heatstroke, habitat destruction and so on. If they take only some of these problems into account, the estimate of the overall harm will be too low, and the carbon tax will be set too low. This could also happen if any of the assumptions in the economic models fail – as they often do.

Another problem with carbon taxes is that they’re aimed at the expected harm of global warming, rather than the possible harm. As the late economist Martin Weitzman showed, if there’s a small possibility of extreme destruction from climate change, it can make standard cost-benefit analysis irrelevant. Carbon taxes are like carrying an umbrella but failing to buy flood insurance.

Taxes also fail to seize one of the biggest opportunities for emission reduction – technological switching. As writer Ramez Naam has pointed out, nudging companies to adopt carbon-free technologies – many of which are now cost-competitive with fossil fuels – can get much more bang for the buck than a tax.

Furthermore, carbon taxes won’t be sufficient to build the infrastructure required for the shift to green energy. Traditionally, the private sector isn’t very good at carrying out big public-use projects like building smart grids. Taxes won’t change that fact.

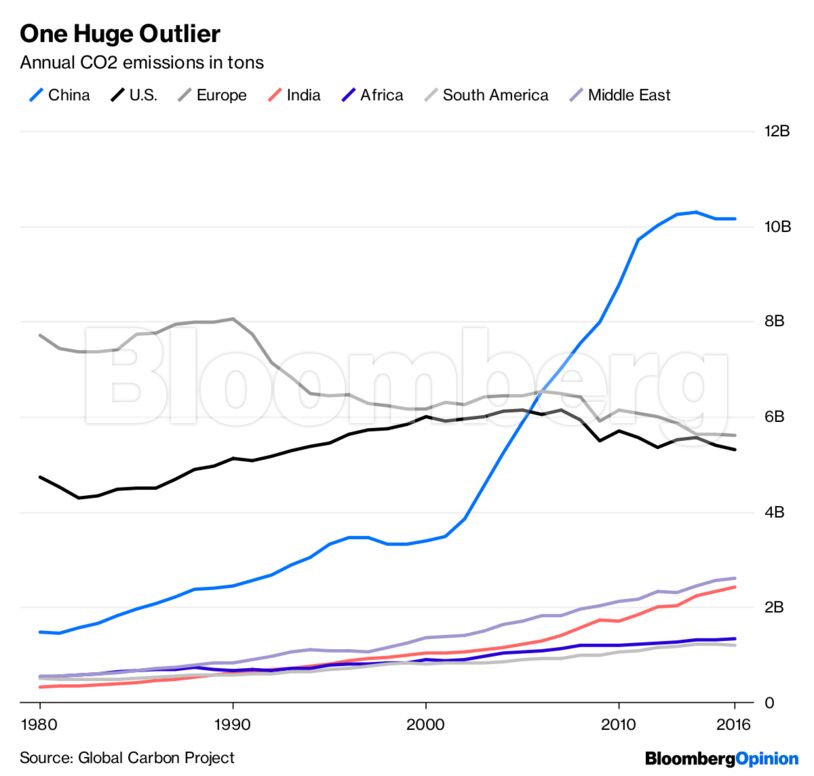

Carbon taxes have one more big defect – warming is global, but the taxes are not. The U.S. emits a lot of carbon per person, but in total terms it’s a modest and shrinking slice of global emissions:

Let’s hope developing countries such as China will follow the moral example of the U.S. and implement their own stringent carbon taxes. But there’s no guarantee they will. Developing countries’ top priority is to build middle-class wealth and alleviate poverty, and any tax that threatens their growth will be a non-starter. In a troubling twist, by reducing demand for oil and other internationally traded fossil fuels, a U.S. carbon tax could lower the price of these fuels for China and other countries, slowing their transition to renewables.

Do these problems mean a carbon tax is useless? No – it’s a good thing. A carbon tax can do something that more targeted policies like renewable-energy mandates can’t. By changing incentives throughout the economy, it can encourage companies to implement a host of small measure to save energy and cut emissions that more direct government intervention might overlook. A carbon tax acts like the mortar in a wall, sealing the small gaps between the bricks. So the people crafting big, ambitious climate plans shouldn’t leave it out.

But on its own, it’s not enough. And both economists and policy wonks should stop treating it as a substitute for other measures. It’s just one piece of the solution.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein