By Liam Denning

(Bloomberg Opinion)

In capital markets, trust boils down to – what else? – money. The more trusted you are, the more money investors will give you at a relatively low cost. Trust is in the eye of the beholder, of course. The U.S. government borrows fantastical sums at next to nothing, as you might expect. Then again, WeWork was also showered with cash despite a gaping wound of a P&L statement and multiple red flags.

Some of the world’s biggest oil companies were grappling with this squishy concept at a Monday gathering on the fringes of United Nations Week in New York. The Oil and Gas Climate Initiative is a group of 13 majors representing roughly a third of global oil and gas production. Founded in 2014, it aims to provide a reasonably unified industry response to climate change, with a particular focus on such things as reducing methane emissions and encouraging carbon capture technologies.

Or maybe it’s greenwashing. That, at least, was the gist of one of the opening, and more provocative, questions posed in a long afternoon session at the Morgan Library & Museum. Ben van Beurden, CEO of Royal Dutch Shell Plc, gamely took it on, arguing the sheer scale of the climate-change challenge means big, motivated companies like his must play a crucial role. It’s a valid point, and Shell has moved perhaps the furthest in realigning its business and targets in this way.

But the industry must contend with the reason he had to answer the question in the first place: decades of opposition to taking action. That same day, not too far from the OGCI’s gathering, teenage activist Greta Thunberg delivered a scathing speech on that very subject to assembled world leaders. While many, including the U.S. president, have reacted with sarcasm or worse to Thunberg’s campaign, millions have come out in support; and her frustration at the lack of urgency about climate change is justified.

Darren Woods, CEO of Exxon Mobil Corp., framed the challenge of meeting energy demand while reducing carbon emissions as an “evolution” of the industry, which will be led by technology. He is right about the latter, but I suspect technologies like Twitter and other social media could play an even bigger role than things like biofuels from lab-grown algae.

Ignoring or obfuscating climate change for many years has had a similar effect to pulling on an elastic band. Frustration and a sense of urgency on the issue have grown, dovetailing with our wider political environment of anger, memes and divisions between party tribes and generational cohorts. A carbon tax, as the OGCI calls for, would constitute an evolution of sorts, albeit a wrenching one. Bold as that might seem, though, the long delay means it now jostles with more prescriptive proposals that could truly snap the elastic back, disrupting the oil and gas business and maybe stranding assets.

Voters still love the things that oil and gas provide, of course, so there is no guarantee Thunberg’s words or Green New Dealers’ sweeping plans will be anything more than that. Yet the inexorable logic of climate change and falling costs of renewable technologies and electric vehicles suggest change is coming in some form. The point is, the range of potential outcomes may be wide, but that’s a lot different from the more certain world in which the oil majors have been used to operating, where prices swing about and there’s the odd expropriation of assets or war but, in the end, demand always goes up.

While videos of Thunberg’s speech zipped around the ether, another UN-led announcement that day got less attention: namely the formation of the Net-Zero Asset Owner Alliance by a group of institutional heavy hitters managing more than $2 trillion. The group aims to not merely shift their portfolios to compliance with net-zero greenhouse gas emissions by mid-century but also to advocate for companies to similarly align themselves.

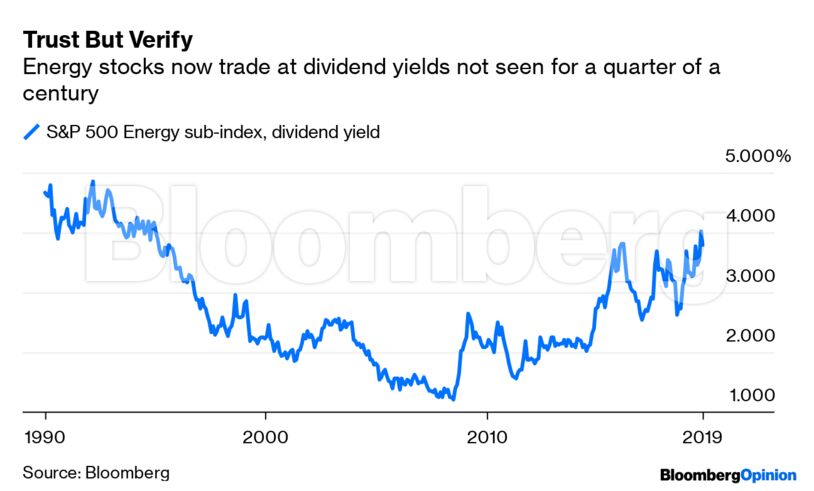

What makes this pressure especially troublesome is that it comes at a time when the sector has only recently begun trying to rebuild trust with capital markets after the oil crash. Scarred by poor returns and wary of the climate-change crapshoot, generalist investors have backed away. This is trust, or the lack of it, manifested as money. As I wrote here with my colleague Nathaniel Bullard, energy stocks now sport dividend yields at their highest levels in 25 years.

The day after attending the OGCI gathering, Patrick Pouyanné, the CEO of Total SA, announced the French oil major would bump its dividend growth from 3% to 5-6% a year, effectively distributing an extra $5 billion to investors through 2025. This both advertises Total’s confidence in its low breakeven oil prices and bumps its own yield closer to 6%. In other words, it’s a big call on investors to trust the company’s got this.

This is the difficult balancing act the industry must now pull off. In the year through June, the OGCI’s members collectively paid out $138 billion of dividends. Technically discretionary, they are now more like the ante just to play. Yet investors are demanding a bigger cut of cash flow even as these companies, to varying degrees, are trying to not only maintain their current operations but also invest in newer technologies that aren’t likely to generate the cash needed to support those payouts anytime soon.

Investors’ trust in the industry’s ability to deploy capital effectively in its core business has waned. Now it must rebuild that while also asking for trust to spend money on entirely new ventures – and all against the backdrop of denuded societal trust. The companies are compelled to try anyway. You can trust it won’t be easy.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein