By Grant Smith and Heesu Lee “Oil markets are broadly balanced at the moment, benefiting from the typical seasonal acceleration in demand,” said Martijn Rats, global oil strategist at Morgan Stanley. Crude is still heading for its second monthly drop this year amid spreading pessimism over international trade and economic growth. However, prices are drawing some support from political tensions in the Middle East, with Iran’s leadership rebuffing suggestions of a meeting with President Donald Trump until the U.S. lifts sanctions on the country. West Texas Intermediate crude for October delivery rose 70 cents, or 1.3%, to $55.63 a barrel on the New York Mercantile Exchange as of 8:28 a.m. local time. It settled $1.29 higher on Tuesday.

Brent for October settlement advanced 59 cents, or 1%, to $60.10 a barrel on the ICE Futures Europe Exchange, after rising 1.4% on Tuesday. The global benchmark crude traded at a $4.48 premium to WTI.

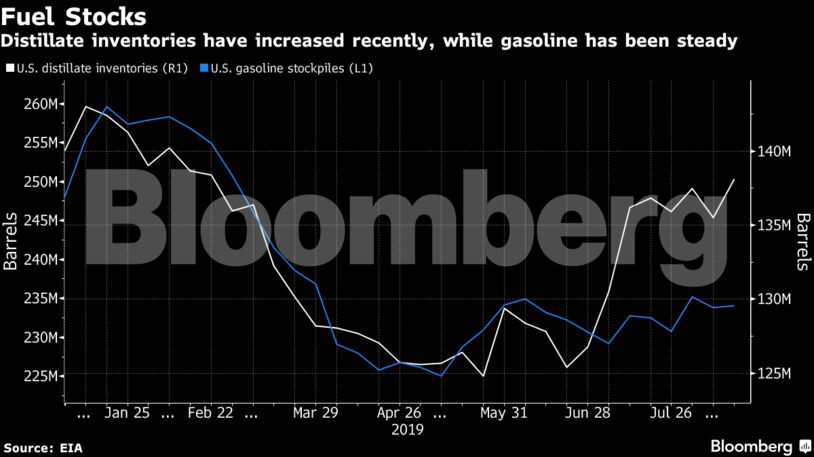

The API’s data for the decline in U.S. crude inventories surpasses the 2.85 million barrel draw estimated in a Bloomberg survey of analysts. If the API figures are confirmed by Energy Administration data, it will be the second drop in a row following two weeks of gains that raised oversupply fears.

The Organization of Petroleum Exporting Countries and its allies said they expect a “significant” decrease in global crude stockpiles in the second half of this year after they trimmed output more than planned. The Joint Ministerial Monitoring Committee, composed of key nations from the OPEC+ coalition, said the group’s implementation of cutbacks was 159% in July.

Oil-market news

Share This:

Oil Rises After Report Shows Steep Decline in U.S. Inventories

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS