By Heesu Lee and Grant Smith

Crude rallied late last week after Saudi Arabia signaled it would seek to halt the price slump, and constrain its exports next month. Still, prices are down this month because of fears the U.S.-China spat may expand into a currency war. The International Energy Agency on Friday trimmed its forecasts for oil-demand growth this year and next, and warned that it may lower the estimates further as the trade conflict drags on.

“Oil is facing severe global headwinds at the moment from the escalation of the trade war, weak macro data and a strong U.S. dollar,” said Jens Naervig Pedersen, a senior analyst at Danske Bank A/S in Copenhagen. “It is difficult to see what can break the downward spiral near-term as the market seems to be waiting for the next round of bad news.”

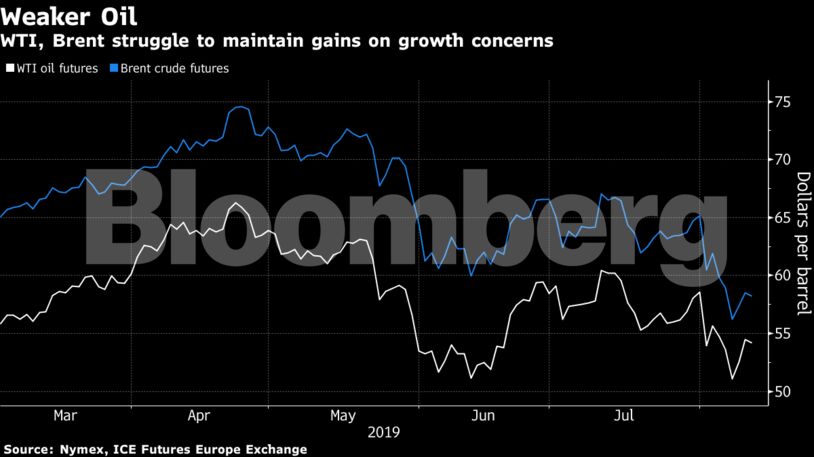

West Texas Intermediate crude for September delivery fell as much as 96 cents to $53.54 a barrel on the New York Mercantile Exchange, and traded for $53.74 as of 10:35 a.m. London time. The contract advanced 3.7% on Friday, trimming a second weekly loss.

Brent for October settlement retreated 50 cents, or 0.9%, to $58.03 a barrel on the ICE Futures Europe Exchange. The contract added $1.15 to close at $58.53 on Friday, trimming the weekly loss to 5.4%.

The global benchmark crude traded at a $4.38 premium to WTI for the same month. It narrowed to as little as $4 a barrel on Friday, the tightest spread since June 2018, after the closure of a refinery operated by Philadelphia Energy Solutions left a surplus of cargoes from the North Sea.

See also: Demand For Oil Is Getting Gloomy: Julian Lee

Trump said earlier this month that new tariffs on Chinese imports will take effect Sept. 1, shattering a truce reached with President Xi Jinping weeks earlier. It unleashed tit-for-tat actions on trade and currency policy that risk accelerating a wider geopolitical fight between the two countries.

Saudi Arabia plans to keep crude exports below 7 million barrels a day in September as it allocates less oil than customers demand, unidentified officials from the kingdom said last week. State-run Saudi Aramco will provide customers across all regions with 700,000 barrels a day less than they requested, the officials said.

“Oil continues to be sensitive to trade war rhetoric,” Alfonso Esparza, a senior market analyst at Oanda Corp., said in a note. “Saudi Arabia is willing to do more to prevent a free fall, but it’s hard to imagine what that would look like. The prolonged trade war has been a negative factor for global growth estimates.”

| Oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS