By Joanna Ossinger

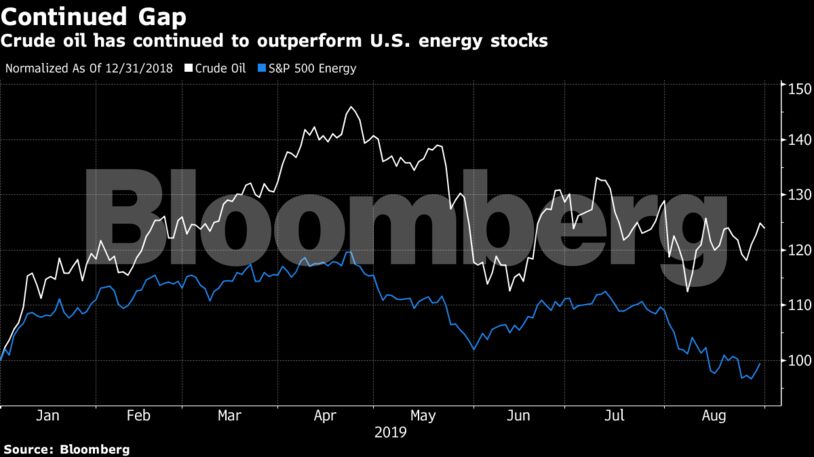

“Where I see our customers actively trading is the energy sector,” TD Ameritrade Singapore Chief Executive Officer Chris Brankin said in an interview. “There’s a lot of focus on the big oil equities as they’re down on the year and oil is up. Which one is right?”

Brankin points to companies like Exxon Mobil Corp., Chevron Corp., Halliburton Co. and Schlumberger Ltd. as those getting attention from clients. He added that some energy companies are paying relatively high dividend yields.

Morgan Stanley’s analysis “suggests that investors should scout for majors with the highest dividend yields, low near-term expectations for free cash flow, a healthy degree of gearing, a capex-to-dividend ratio that is not too low, and where there is a credible path to superior free-cash-flow growth,” analysts led by Martijn Rats wrote in a note. “If the shares have underperformed recently, all the better.”

They noted that BP Plc met the criteria, reaffirming their overweight rating on the stock. Of course, there are reasons energy stocks have suffered.

Integrated oil companies “can add some portfolio ballast, but return potential is modest,” according to Brian Barish, chief investment officer at Cambiar Investors LLC in Denver. He is “not very constructive” on energy stocks, especially those in exploration & production or services. Halliburton and Schlumberger both deal with oil-field services, while Chevron and Exxon Mobil are generally considered integrated oil companies.

“Long term the market structure of oil has become much worse owing to the prolific nature of shale,” Barish said in an email. “So forecasting a correct price/earnings multiple is difficult, adding to the challenge.”

Sundial Capital Research Inc.‘s Jason Goepfert sees a sector that has been beaten down and it “can’t generate any buying interest,” but the market may be close to a bottom.

“Over the past month, an average day has seen nearly 15% of the stocks sitting at a 52-week low. That’s creeping up on some of the most sustained bouts of selling pressure in almost 20 years,” Goepfert wrote in a note Wednesday. “The other times this happened, the Energy Select Sector SPDR Fund saw gains all but twice over the next six months.”

Share This:

Morgan Stanley Quants Pick Energy Stocks as TD Sees Asia Demand

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet