By Julian Lee

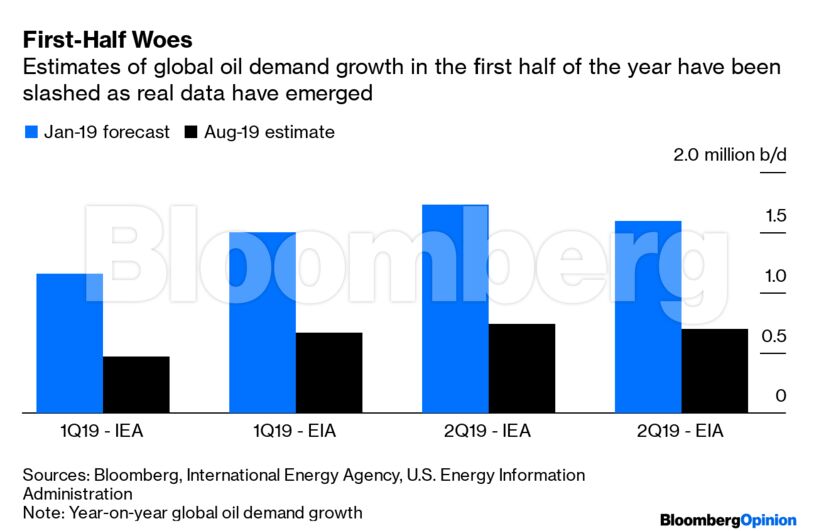

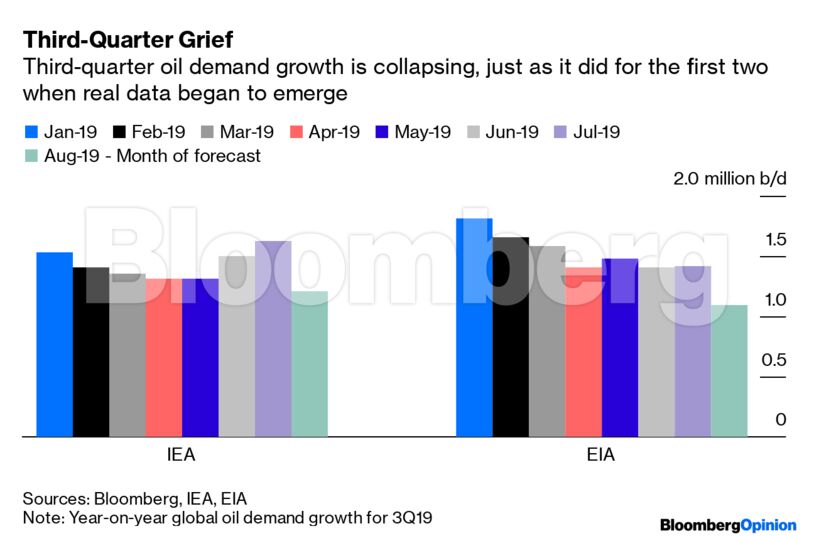

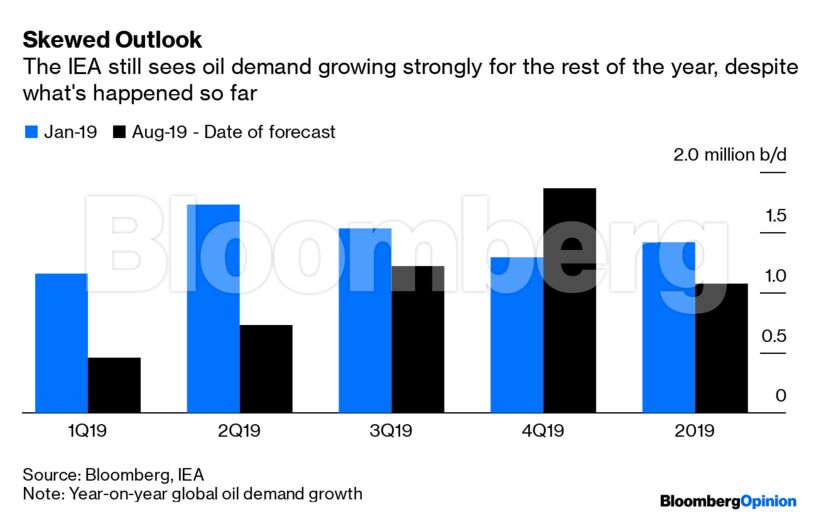

Until last week, the two agencies were still forecasting robust demand growth of about 1.5 million barrels a day for the third quarter. Indeed, the IEA had increased its forecast for the third quarter in both June and July at the same time as it was slashing its estimates for the earlier periods. It cited a combination of “expected stronger economic growth in the OECD in the second half of 2019, as well as the fact oil prices remain lower than last year,” alongside the commissioning of several petrochemical plants in the second half of the year. It also noted that its view assumed “that the trade standoff between China and the US does not deteriorate.”

Those assumptions are no longer tenable. The U.S.-China standoff has deteriorated and it could get a lot worse before it gets better, depending how China responds to the latest tariff threats from Washington. Fears of a broader economic slowdown are also boosting the value of the dollar against currencies like the euro and the Chinese yuan as investors seek safe havens for their money. That is making oil more expensive in non-dollar economies, offsetting some of the impact of cheaper dollar-denominated crude.

Full-year demand growth forecasts of around 1 million barrels a day are being supported by increasingly positive outlooks for the fourth quarter. But with predictions for the third quarter also drifting down, it may not be long before the IEA and EIA start reducing those rosy numbers for the final three months of 2019.

That will leave OPEC and friends with a big problem. They have only just agreed to extend their current deal to cut output until the end of March. That decision was meant to show the group’s determination to shore up oil prices, but it already looks like falling well short of what’s needed.

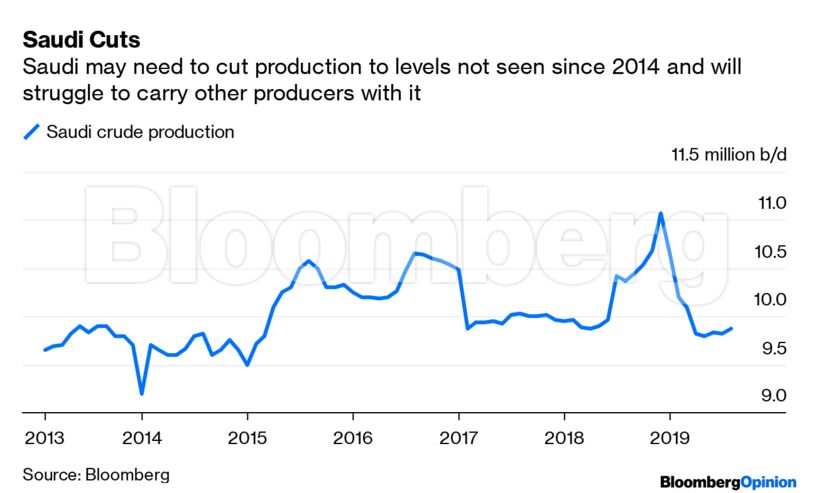

Saudi Arabia says it will not tolerate a continued slide in prices, but it has few options to halt the slump. Its production is already set to fall in September, when it will supply customers with 700,000 fewer barrels a day of crude than they have asked for. It may soon have to drop to levels not seen since the kingdom was trying to prop up prices in 2013-14. That policy didn’t work so well for them. Oil prices still collapsed in the second half of 2014, even with robust demand growth.

Prices responded positively to the latest signs of Saudi resolve, but it will take more than words to prevent the gloom from settling again. Brent crude fell as low as $55.88 a barrel on Wednesday, wiping out most of the gains it had made this year. But the problem doesn’t lie with supply. More output cuts – even if they are shared among OPEC+ producers, which seems unlikely – will do nothing to stimulate oil demand. That will require President Donald Trump to complete some of those trade deals he keeps tweeting about.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS