By Brian Eckhouse and Molly Smith

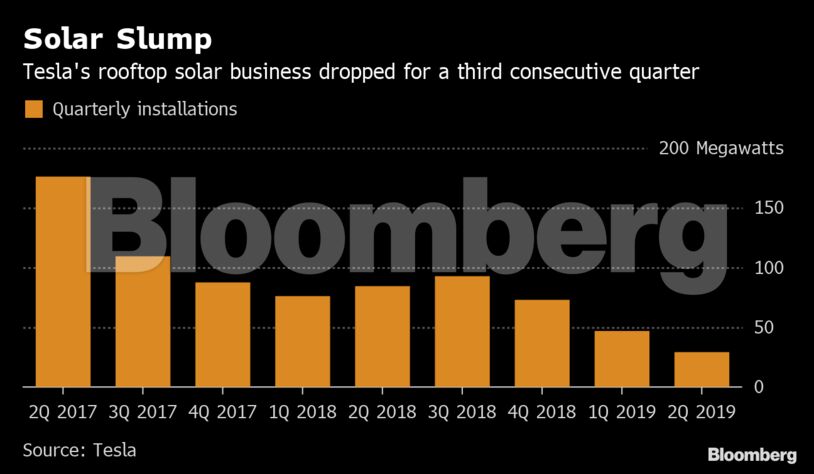

The company, which makes most of its revenue from automobiles, installed 29 megawatts of solar last quarter, down from 47 megawatts in the first three months of the year. Tesla installations have now declined in six of the last eight quarters.

Tesla bought SolarCity Corp. in late 2016 for $2.6 billion and subsequently relinquished the rooftop throne to Sunrun Inc. It dropped from the No. 2 spot earlier this year and has since slashed prices and ceased offering custom-designed systems.

“They’ve always wanted to do rooftop solar on a national scale and through heavy growth, but it’s not clear that they want to invest enough in the company to be a top residential-solar installer,” Michelle Davis, a solar analyst at Wood Mackenzie Power & Renewables, said in an interview. “We don’t anticipate Tesla being in solar for very long.”

A Tesla spokesman declined to comment beyond referring to previous company statements. In its second-quarter investor letter released Wednesday, Tesla said: “We are in the process of improving many aspects of this business to increase deployments.”

Tesla Falls as Margins Shrink and Musk Favors Growth Over Profit

Tesla’s solar unit has amounted to little in the way of earnings. It has, however, generated debt. More than a fifth of Tesla’s $10 billion in outstanding debt comes from the segment. Much is non-recourse, meaning it’s backed by solar projects rather than the company itself. So Tesla wouldn’t necessarily be liable if the debt goes unpaid.

The most imminent is a $566 million convertible bond due in November, and analysts have said it’s unclear whether it would be in the company’s best interest to default. The move could spare cash-strapped Tesla from putting half a billion dollars toward a struggling business. On the other hand, it could be a significant black mark on the firm’s reputation and overall credit worthiness.

Tesla’s main solar rivals — including Sunrun and Vivint Solar Inc. — report second-quarter results next month. Another contender, Houston-based Sunnova Energy International Inc., was set to price shares Wednesday for its initial public offering.

–With assistance from Christopher Martin.

To contact the reporters on this story:

Brian Eckhouse in New York at [email protected];

Molly Smith in New York at [email protected]

To contact the editors responsible for this story:

Lynn Doan at [email protected]

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein