By Heesu Lee and Grant Smith

Oil is little changed this month after swinging between gains and losses as global growth concerns compete with the standoff in the Persian Gulf. While optimism that the U.S. Federal Reserve will cut interest rates is brightening the outlook for oil demand, a new round of trade talks between China and America showed little evidence of progress.

“Supply fundamentals still remain supportive of oil prices, and are tightening given the effectiveness of U.S. sanctions that have reduced Iran’s crude oil exports to a trickle,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. But for “oil to move higher, the market is going to need a positive economic catalyst.”

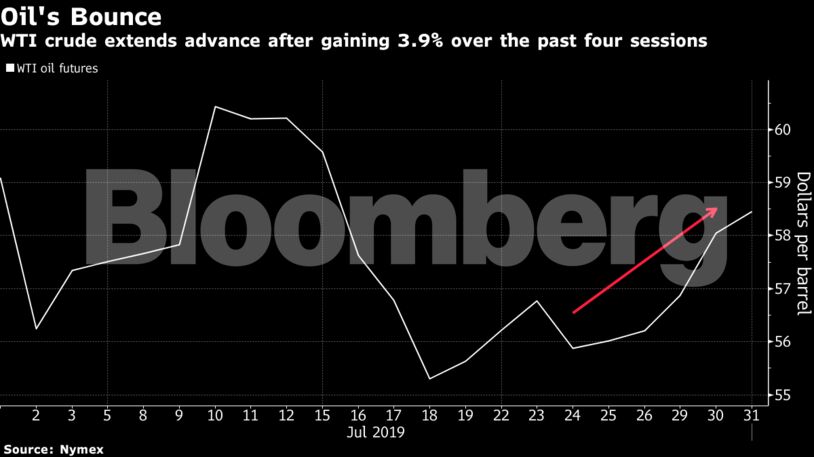

West Texas Intermediate for September delivery rose as much as 62 cents to $58.67 a barrel on the New York Mercantile Exchange, and traded at $58.65 as of 8:47 a.m. local time. Prices are up for a fifth day, after climbing 2.1% on Tuesday, the biggest gain since July 10.

Brent crude for September, which expires Wednesday, added 54 cents to $65.26 a barrel on the ICE Futures Europe exchange, after rising 1.6% on Tuesday. The more-active October contract was at $65.19, up 56 cents. The September contract traded at a $6.85 premium to WTI for the same month.

See also: Guaido’s Envoy Says Chevron Waiver Is Bad News for Maduro Regime

A steady decline in U.S. crude inventories has alleviated some demand concerns. American stockpiles have dropped for six weeks through July 19, the longest run of losses since January 2018. Government data on Wednesday is forecast to show supplies fell by 2.75 million barrels, according to a Bloomberg survey, less than the American Petroleum Institute’s estimate.

Tensions have escalated in the Persian Gulf in recent months after a series of attacks on tankers and drones, while Iran is being subjected to U.S. sanctions that have squeezed its oil exports. The Middle East nation has reached a deal with Russia to hold a joint military drill in the Indian Ocean by March 2020, semi-official Fars News reported, citing the commander of the Iranian navy.

| Oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet