By Grant Smith

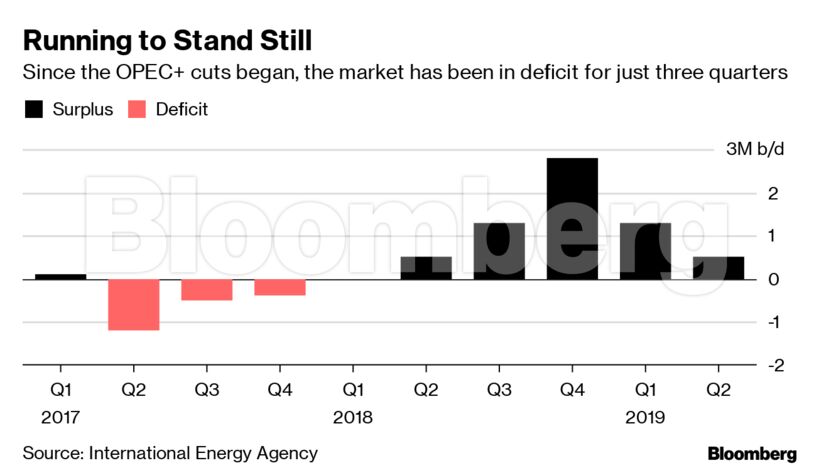

World supply exceeded demand at a rate of 900,000 barrels a day during the first six months of 2019 as consumption proved far weaker than expected amid a faltering economy, the IEA said. With the outlook for 2020 also deteriorating, the Organization of Petroleum Exporting Countries may need to reduce output to the lowest in 17 years to keep markets in balance, the agency predicted.

“This surplus adds to the huge stock-builds seen in the second half of 2018,” the Paris-based IEA said in its monthly report. “Clearly, market tightness is not an issue for the time being and any rebalancing seems to have moved further into the future.”

Global oil demand grew at the weakest pace since 2011 in the first quarter, and by a third less than anticipated in the second, amid the first contraction in manufacturing activity in seven years, according to the agency. That thwarted efforts by OPEC and its partners to keep markets in equilibrium by cutting production.

Although crude prices have recovered by about 25% in London this year, at about $67 a barrel they remain considerably below last year’s peak. That’s a problem for Saudi Arabia and others in the OPEC cartel, who need higher price levels to cover government spending.

Last week the organization and its partners — a 24-nation coalition known as OPEC+ that includes Russia — agreed to keep output restrained until early 2020 to check the formation of a new glut. But the report on Friday from the IEA, which advises most of the world’s major economies, is another sign that OPEC’s challenge is getting harder.

As recently as last month, the IEA thought that world oil stockpiles grew only slightly in the first half of this year as a surge in the first quarter was tempered by a pullback in the second.

But in its latest report, the agency slashed estimates for global demand growth during the second quarter by 450,000 barrels a day to 800,000 a day, while also raising its assessment for new supplies outside OPEC. Non-OPEC supply continues to expand, driven by the boom in U.S. shale oil. As a result, oil inventories accumulated substantially during the first half.

While the agency’s forecast for demand growth in 2019 as a whole remained steady, at about 1.2 million barrels a day, it hinges on an assumption that economic recovery will spur a massive rebound in the second half, with consumption expanding roughly three times as much as in the first.

Call on OPEC

The task faced by OPEC next year is also growing tougher, as the IEA lowered its forecast for demand in 2020 and boosted projections for non-OPEC supply.

In consequence, the amount of crude needed from the organization — which pumps more than a third of the world’s oil — will slump again next year, to considerably below its current rate of production.

The IEA forecasts that an average of 29.1 million barrels a day will be required from the group, whose 14 members pumped 29.9 million a day last month, when their output was already reduced by voluntary cutbacks as well as political crises in Iran and Venezuela.

To prevent another surplus in 2020, OPEC would need to cut output on average by a further 800,000 barrels a day, and throttle back in the first quarter to a rate of just 28 million a day, a level it hasn’t produced since 2003. If the group doesn’t take this action, stockpiles may balloon in early 2020 by 136 million barrels, the agency predicted.

“Clearly, this presents a major challenge to those who have taken on the task of market management,” the IEA said.

OPEC itself acknowledged the predicament on Thursday, when its own first detailed assessment of 2020 fundamentals indicated that oil supplies may pile up next year unless the organization makes deeper cuts. However, Saudi Energy Minister Khalid Al-Falih signaled last week that the kingdom — which has already slashed production by far more than initially planned — is reluctant to shrink supplies further.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS