By Ben Sharples and Saket Sundria

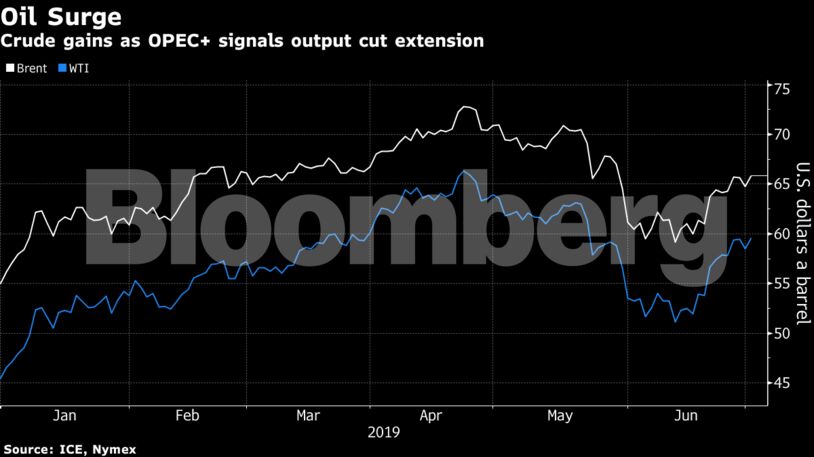

Futures rose as much as 2.8% after rallying more than 11% over the past two weeks. Other OPEC members have indicated their support for the agreement between Russian President Vladimir Putin and Saudi Crown Prince Mohammed Bin Salman to prolong the curbs by six to nine months before their meeting in Vienna this week. Washington and Beijing declared a second truce to their trade war and the U.S. will hold off on imposing additional tariffs on China.

Oil capped its biggest monthly gain since January on Friday after escalating tensions in the Middle East spurred concerns crude flows from the region may be disrupted. While Nigeria, Iraq and Oman flagged support for the Saudi-Russia deal, it’s still unclear whether the proposal will win unanimous support from all members of the coalition. The group that includes the Organization of Petroleum Exporting Countries has typically aimed for half-year output agreements.

“The market is more relieved than happy,” said Vandana Hari, founder of Vanda Insights in Singapore. The trade deal was basically just a cease-fire and an extension of the OPEC+ cuts was a “foregone conclusion,” she said.

West Texas Intermediate oil for August delivery climbed $1.24 to $59.71 a barrel on the New York Mercantile Exchange as of 10:03 a.m. in Singapore after advancing as much as $1.63 earlier. The contract added 9.3% last month.

Brent for September settlement rose $1.33, or 2.1%, to $66.07 a barrel on the ICE Futures Europe Exchange. The August contract expired Friday,. The benchmark global crude traded at a premium of $6.36 to WTI

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire