By Sharon Cho and Grant Smith

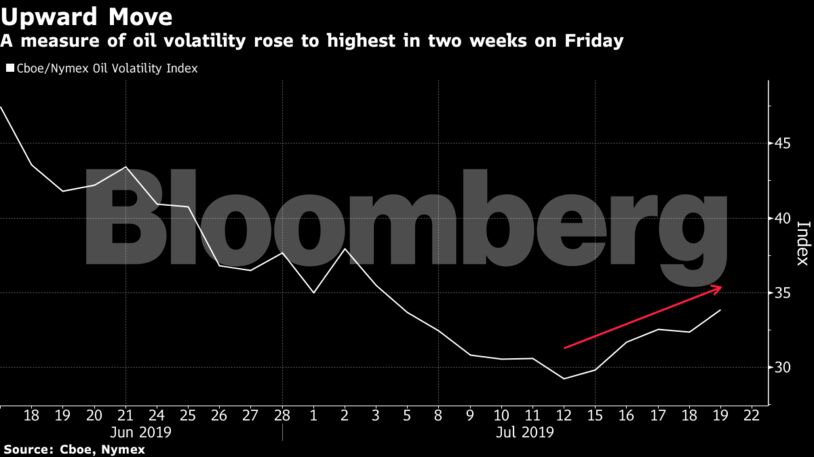

Oil volatility rose to a two-week high on Friday after the tanker seizure highlighted the risk of flows through the world’s most critical crude choke-point being disrupted. Nonetheless, prices lost more than 6% in London last week, their sharpest pullback in more than a month, on concerns that a slowing global economy will continue to weigh on oil demand.

See also: How a Persian Gulf Conflict Could Impact Commodities Markets

“We’re just not seeing prices react very strongly” to the situation in the Gulf, “primarily because of this macroeconomic backdrop and the concerns the oil market has about what that means for global oil demand,” Richard Mallinson, an analyst at consultant Energy Aspects Ltd., said in a Bloomberg television interview.

Brent for September settlement rose as much as $1.6, or 2.5%, to $64.03 a barrel on the ICE Futures Europe Exchange and traded at $63.73 as of 10:44 a.m local time. The global benchmark crude traded at a premium of $7.01 to its American counterpart, WTI, for the same month.

West Texas Intermediate for August delivery added $0.96, or 1.73%, to $56.59 a barrel on the New York Mercantile Exchange. The contract fell 7.6% last week.

While the U.K. government has threatened Iran with “serious consequences” over the tanker seizure and advised British ships to avoid the area, ministers on Sunday sought to dial down the rhetoric. Tensions have flared after a tanker carrying Iranian oil was seized by U.K. forces near Gibraltar in early July. Around a third of all seaborne crude flows through the Strait of Hormuz.

Libyan oil production is set to recover from a five-month low as the North African supplier’s biggest field restarts following a brief halt.

The country’s crude production fell to about 1 million barrels a day, after a valve in a pipeline carrying crude from the Sharara field to the Zawia refinery was closed. The valve was re-opened Sunday night, the state-run National Oil Corp. said. The declaration of force majeure — which was lifted Monday — removed 290,000 barrels a day of production, it said in an earlier statement.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet