By Heesu Lee and Alex Longley

Futures erased losses of as much as 0.8% in New York after retreating 1.1% on Monday amid a slew of weak U.S. data. Meanwhile, the Organization of Petroleum Exporting Countries and its allies have shifted their focus to mid-July for the next meeting to discuss extending production cuts, after talks between Russia and Iran made some progress toward resolving a standoff over the date.

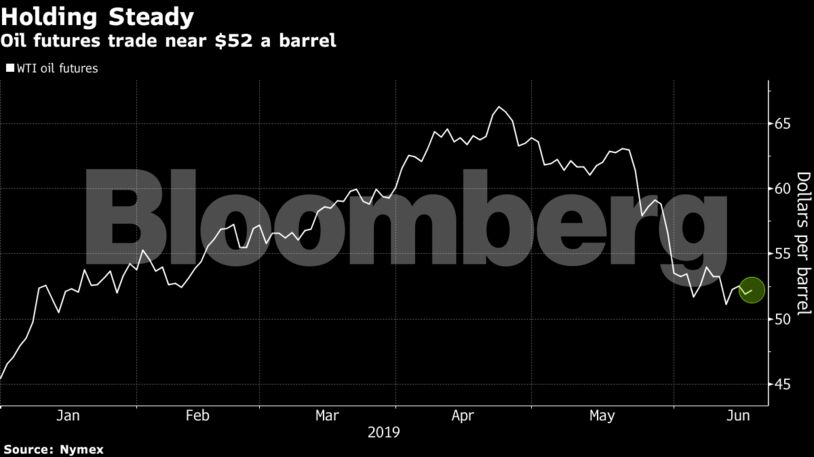

Oil has lost about 20% since late April as growing American inventories and an entrenched trade dispute between the U.S. and China continue to cloud the demand outlook. While last week’s attacks on two tankers near the Strait of Hormuz raised concerns about a disruption to crude flows, focus has returned to OPEC’s attempts to fix a meeting on supply cuts that are due to expire at the end of the month.

“Europe sold oil this morning on a stronger dollar, and now the U.S. is buying the market on more stimulus expectations,’’ said UBS AG analyst Giovanni Staunovo.

West Texas Intermediate for July delivery added 22 cents to $52.15 a barrel on the New York Mercantile Exchange as of 8:47 a.m. New York time. Futures settled Monday at $51.93.

Brent for August settlement gained 2 cents to $60.96 a barrel on London’s ICE Futures Europe Exchange. Futures slid $1.07 to close at $60.94 on Monday. The global benchmark crude traded at a $8.61 premium to WTI for the same month.

After a meeting on Monday, OPEC and its allies appeared to be moving toward mid-July as a possible date for the next meeting to discuss output cuts. Their failure to agree on a date has given turbulent oil markets little reassurance about the future of production cuts amid an overall slump in crude prices in recent weeks. Iran said Monday it was willing to hold a meeting July 10-12. The group had originally planned to meet next week.

The dispute over the timing of the meeting is playing out amid a broader geopolitical confrontation as Saudi Arabia accuses Iran of complicity in attacks on the two oil tankers. Iran has denied culpability.

| Other oil market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS