By David Yager

Oilfield Services Executive Advisory – Energy Policy Analyst

December 18, 2017

Three years and three weeks after the ill-fated November 2014 OPEC meeting which precipitated the world oil price collapse, the light at the end of the tunnel may not be a train. In terms of opportunities for all the players in Canada’s battered oil and gas industry – oil companies, service and supply and workers – things look better for next year than they have in some time.

There will be some sort of oil price stability and possible major price increases as global supply and demand approach equilibrium. Canadian governments appear to have quit inventing new ways to obstruct and penalize the ‘patch. Sometime next year either TransCanada, Kinder Morgan or both may start digging ditch for new export pipeline takeaway capacity. These three factors alone will provide a level of stability missing for three years.

Nevertheless, unbridled optimism is unwarranted. Pipeline outages, backups and new oil sands production have again torpedoed oil price differentials resulting in the biggest discounts in years. Natural gas prices remain terribly depressed. Oil prices are still US$40 a barrel below what they once were. Carbon taxes rising January 1 and higher corporate taxes are already in place. Significant methane reduction expenses loom. The regulatory burden remains undiminished. While comforting words are being spoken by politicians who have hardly been cheerleaders for oil and gas, neither KXL or Kinder Morgan are under construction.

And to ensure long-term uncertainty, hypocritical opposition to petroleum as THE essential energy source continues unabated. Washington’s Energy Information Administration (EIA) figures global oil demand will reach nearly 100 million b/d in 2018. When Jean Chretien signed the Kyoto Accord 20 years ago in 1997, world oil demand was only 73.8 million b/d. That crude consumption has increased 36% since it was declared a threat to the planet proves petroleum’s critics are clearly not on the same page as consumers.

Oil forecasts are fraught with peril and perpetually inaccurate. But you can take the following to the bank. Maybe.

World Oil Supply/Demand in Balance

Demand will grow again in 2018. Reservoir depletion continues 24/7/365. Capital expenditures on new reserves have plummeted globally. Broad concerns exist that by the end of this decade these factors may leave the world with a significant supply deficit potentially creating crude price spikes. That’s why they call oil prices volatile.

But it certainly looks improved for next year according to the International Energy Agency (IEA).

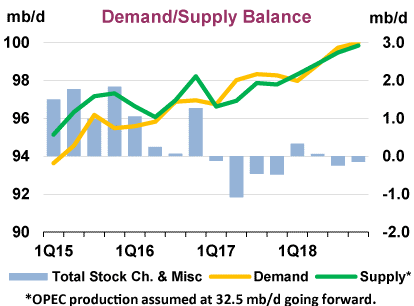

Source: International Energy Agency December 14, 2017

Oil supply is green, oil demand yellow and “stock changes” are blue. This is the amount either added to or withdrawn from storage. While the future is always conjecture, the historical figures are illuminating.

For 2015 through to Q4 2016 production exceeded consumption by as much as two million b/d resulting in major inventory builds. This didn’t change until November 2016 when OPEC and cooperating non-OPEC members agreed to withhold 1.8 million b/d of output to help restore balance and draw down inventories. Note stock draws through 2017 and further withdrawals or only nominal builds to the end of 2018 apart from Q1, historically the period of lowest demand.

The price of WTI in the past 3.5 years underscores the definition of volatile. Starting in late 2014 oil generally declined until WTI hit US$26.19 February 11, 2016, a 76% reduction from its recent peak of US$107.52 on June 16, 2014. After OPEC reintroduced supply management in late 2016, by February 23, 2017 WTI had jumped to US$54.48, more than double that of the previous year. What a ride.

But what the data clearly illustrates is the massive supply surpluses that characterized 2015 and 2016 are gone. While the oil price ceiling remains unknown, crude finally has a floor. This will provide a level of confidence and stability absent for three years.

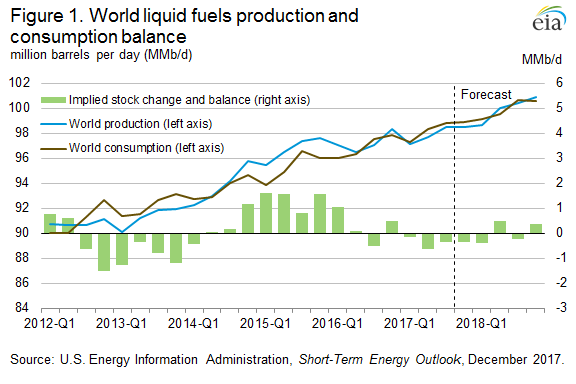

The EIA released its version of the same data December 13.

EIA data goes back to 2012 and shows production in blue, consumption in brown and stock (inventory) changes in green. The green stock declines in 2012, 2013 and most of 2014 illustrates why prices were high. Then the supply/demand lines cross and the green bars show significant inventory builds in 2015 and 2016, the period of the price collapse. Things improve in 2017 then EIA sees supply and demand mostly in balance for 2018 with inventory declines or only modest builds. This is a totally different global supply/demand dynamic than experienced during the crude price collapse.

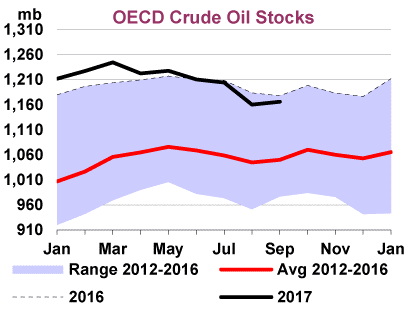

Source: International Energy Agency November 14, 2017

The rebalance of crude markets has finally had an impact on crude oil stocks which includes everything from storage tanks (field and facilities) to pipelines to tankers. By September inventories had re-entered the five-year average range and were within 100 million barrels of the five-year average. To put the “enormity” of this surplus into perspective, 100 million b/d is slightly above global oil production and consumption for one day.

The EIA reported December 1 that total U.S. inventories (not including the Strategic Petroleum Reserve) were 448 million barrels, down 16% from the recent peak of 536 million barrels March 31, 2017. In the fall of 2015 the Obama administration approved American crude oil exports for the first time in decades. Despite steady growth in U.S. light tight oil production, inventories are declining and prices are rising.

High inventories have kept a lid on prices despite potential supply disruptions in unstable Middle East countries, the so-called “risk premium”. High inventories blunt the impact of potential supply cuts. As inventories fall the impact of supply disruption on prices – real or perceived – will become more pronounced.

Government Policy Stable At Last

The greatest indignity to which the oilpatch was subjected AFTER oil prices collapsed was the introduction of punitive and obstructive policies by the new governments of Alberta (May 2015) and Canada (October 2015). Neither government elected anyone with a strong understanding of the petroleum industry. Many of their elected members, including their leaders, have historically expressed distrust, disdain or disrespect for the oilpatch despite Canada being the world’s fifth largest oil and gas producer on a BOE basis. There is not an industry of this magnitude in Canadian history held in such low regard by so many.

Ignoring the realities of the devastating impact of the crude oil price collapse and assuming the industry was impervious to economic and market forces, these governments proceeded to significantly change the rules with a series of highly damaging policies. They included tax increases (corporate and carbon); major commitments at the U.N. climate change meeting in Paris in November 2015 which included methane reductions, carbon emission reductions and the phase-out of coal-fired power generation, all with unknown costs; an oil sands carbon emissions cap; new rules for the National Energy Board; a northern west coast tanker ban; and the termination of the Northern Gateway pipeline.

This was augmented by the election of an NDP government in B.C. committed to doing whatever it could to stop the expansion of Kinder Morgan’s Trans Mountain pipeline.

At one point CAPP President and CEO Tim McMillan, who is paid well to choose his words carefully, described the actions of governments as “piling on”.

Historically, really stupid policies that persecute the petroleum industry are inevitably reversed. Not immediately of course. Only after the economic damage is clear – companies and workers have suffered mightily and capital outflows begin to affect the presiding jurisdiction – do governments undo what they have done. Often it takes a change in government to fix things entirely.

The Ottawa/Alberta energy wars of the late 1970s and early 1980s are a good example. As prices rose capturing the attention of the federal government, Alberta raised royalties through the in the 1970s roof to prevent Ottawa from capturing more money. This was not undone until the early 1990s after contributing to the disastrous decade of the 1980s. After introducing the National Energy Program in 1980, Ottawa soon asked oil companies to quit “Canadianizing” their foreign competitors because of its impact on the dollar and balance of payments. Brian Mulroney’s new government, elected in 1984, fully dispensed with the NEP by 1986.

NDP governments in Saskatchewan and B.C. jacked up royalties and seriously damaged their oil industries. After changes in government they both returned their royalty rates to lower levels. At times the fiscal regimes in these provinces was more attractive than Alberta. It still is in Saskatchewan.

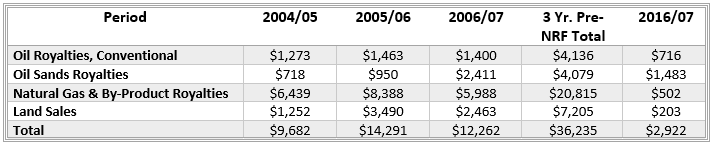

Possibly the most egregious policy change was Alberta Premier Ed Stelmach’s New Royalty Framework (NRF) introduced in October 2007, became law January 1, 2009, and was gone by mid-2010. The following chart tells the story.

Source: Alberta Resource Revenues: Historical and Budget 1971 to 2014, Alberta Department of Energy, for fiscal years ended March 31

Ralph Klein announced after the 2004 election that this would be his last term as Premier. In early 2006 he got a little help after receiving only received 55% support in a regular leadership review. The race to elect his replacement was called and so-called “dark horse” candidate Ed Stelmach won after campaigning on a royalty review. Public hearings into royalty rates were held in Q2 and Q3 2007 resulting in a report in September which claimed Albertans deserved “Our Fair Share”. Legislation was passed in October and became law 14 months later.

The three years preceding Stelmach’s determination Albertans deserved a bigger cut from the ‘patch included the two most lucrative years in the province’s history and the greatest three-year windfall Alberta will likely ever experience. Premier Klein is hailed today as a poster-child for fiscal probity but in fact he ran out of ways to spend all the cash. So he gave $400 cheques to every living Albertan in 2005. Klein’s government was also able to stuff $17 billion into the so-called Sustainability Fund, now gone after a decade of deficits.

Ignoring the massive revenue windfall preceding the NRF and the collapse of world financial markets and commodity prices in the fall of 2008, the NRF become law anyway on January 1, 2009. Because of global events and the exodus of capital, this was all but completely undone by mid-2010.

The current policy overhang from new NDP and Liberal governments remains. Both administrations are running massive deficits due in part to a collapse in royalties, corporate taxes and personal income taxes from oil and gas. Production revenue fell $68 billion from calendar 2014 to 2016. Capital expenditures dropped by $44 billion. The revenue loss is much greater that the annual provincial revenue of B.C. or Alberta and the capital investment loss is close behind. Many international oil companies have abandoned Canada. Given a selection of worldwide opportunities, particularly in the U.S. under the petroleum and business-friendly Donald Trump administration, Canada’s reputation as a safe, predictable and profitable place to investment has been seriously damaged.

While neither government will publicly admit mistakes, the changes in messaging from Edmonton and Ottawa in the past year are noteworthy and remarkable. In late 2016 Prime Minister Justin Trudeau announced federal support for Kinder Morgan and the Enbridge Line 3 replacement, permitting him and Alberta Premier Notley to publicly declare the genius of their carbon taxes and policy changes in obtaining the “social license” to unjam pipeline roadblocks. Last month federal Energy Minister Jim Carr and Premier Notley appeared in public together in B.C.’s hostile lower mainland to express their support for Kinder Morgan.

In early December the National Energy Board over-ruled the obstructionist municipal government of Burnaby to clear the path for Kinder Morgan’s construction to continue without further delays. Premier Notley has probably never said as many positive things about the oil industry publicly in her life as she has in the past 12 months.

Who are these people? Where have they been for the past three years?

President Trump has come to the rescue of Keystone XL which recently received conditional approval from Nebraska, the major condition being TransCanada move the pipeline route. Enbridge’s Line 3 replacement is bogged down by regulators in Minnesota but construction on the Canadian segment has already begun indicating they believe it will be approved one way or another.

Another surprising development was the recent B.C. NDP approval of completing the Site C hydro project in northeast B.C. Wow. An energy megaproject approved by a former staunch opponent. This could provide cheap and reliable power for the west coast LNG industry.

No matter what politicians say when campaigning, when in government they eventually must pay attention to the economy. And without cheap energy and robust resource industries, Canada’s economic prospects are enormously diminished.

Edmonton and Ottawa’s current crusade to over-regulate and over-tax the oil industry while not subjecting other major industries to similar treatment will not stand the test of time.

Why 2018 Will Be Better

With the discount for Canadian heavy oil the highest in four years, natural gas in the dumpster, carbon taxes rising January 1 and the total cost of the methane plan still unknown, there is no reason for oil workers to uncork a bottle of bubbly and celebrate the pending good times in 2018. PSAC and CAODC have released 2018 drilling forecasts that indicate only modest gains.

The new term describing Canada’s challenges coined by ARC’s Peter Tertzakian is “above ground” issues implying the “below ground” issues like reserves, royalties and taxes are manageable. Higher oil prices will help solve these. Above ground issues include pipeline opposition, federal and provincial policy, aboriginal engagement and public opposition to energy development.

But there are two major factors all but certainly resolved for next year. The first is oil prices, which will be stable by comparison. The other is our governments appear to have finally quit lying awake at night cooking up new ways to screw the oil and gas industry.

There are too many moving parts to forecast a major improvement. But for the first time since 2015 things won’t get worse. That is the modern oilpatch definition of better.

About David Yager – Yager Management Ltd.

Based in Calgary, Alberta, David Yager is a former oilfield services executive and the principal of Yager Management Ltd. Yager Management provides management consultancy services to the oilfield services industry in a number of areas including M&A, Strategic Planning, Restructuring and Marketing. He has been writing about the upstream oil and gas industry and energy policy and issues since 1979.

See David Yager’s Corporate CV

List of David Yager’s Consulting Services

David Yager can be reached at Ph: 403.850.6088 Email: [email protected]

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein