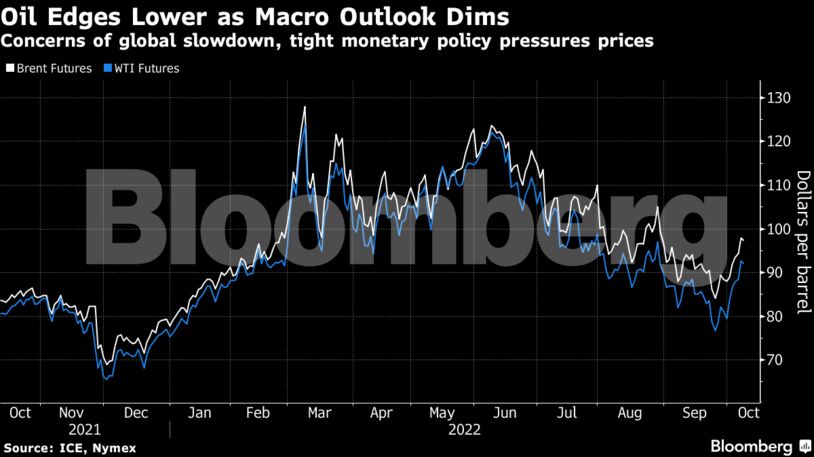

West Texas Intermediate dropped below $92 a barrel on fears the US Federal Reserve will have to go on boosting rates to quell inflation, ending a five-day 17% run of gains. Equity markets also declined and the dollar strengthened, making commodities that are priced in the currency less appealing.

Oil markets remain buffeted by concerns about the global economy and the cuts announced by the Organization of Petroleum Exporting Countries and its allies. Traders are closely watching for demand signals as growth is likely to suffer from central banks’ monetary policy. OPEC+’s output cuts, which drew rebuke from the US, could turn out to be much smaller in reality, but a slew of leading banks said it could still send prices higher this year.

“Markets are taking a breather,” said Hans van Cleef, senior energy economist at ABN Amro Bank. “The OPEC+ news has been digested, so time to look at the demand side again.”

| Prices: |

|---|

|

Key oil-market gauges have shown signs of increased bullishness since the OPEC+ decision last week. The spread between the nearest two December contracts for Brent — a much-watched marker of the market’s health — rallied to the strongest level since June.

At the same time, options markets have seen a flurry of bullish call trades. On Friday, Brent options volumes were the highest since March as traders placed a series of wagers on rising prices.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS